Mastering The Trade

★★★★ The longer I trade, the more I have come to understand that no matter what a trader does—no matter how many indicators or time frames she meticulously studies—a trader can never, never, never predict with 100% certainty what the market is going to do next. Once you realize that you don't need to know, you will stop getting stressed out. The market is going to do what it pleases, regardless of how much confirmation a trader has on a particular trade that may normally have a high probability of working out. The only thing a trader can do is control his risk—on each and every trade. Stay disciplined. Be patient. Remind yourself of this before every trade. If there is a secret to trading, it is this: take the next trade not to make money, but to improve one's skills as a trader. This is how a trader is able to make a living at the game. This is how a trader is able to avoid a catastrophic loss.

★★★★ For traders without the discipline to follow their rules, the possibility of financial ruin is not a question of "if." It's only a matter of "when." The ones who turn the corner and eventually start making a living at this profession learn to stick to their rules. This is typically a painful process. There is only one guarantee I can give you in this business, and it is this: if you can't stick to the rules you develop, and if you are always finding some excuse to enter or exit a trade earlier or later than your rules state, you will never, never make it as a trader.

★ Huge lessons:

- Never use market order → use limit order

- Don't have too tight stops → wide stops

- Don't overtrade → undertrade

★ Strategy #1. SKEW - CBOE skew index. Hedge funds worried about 2 SD correction. Draw solid horizontal trendlines at 140 and 125. Draw dashed horizontal trendlines at 130 and 125.

- Over 135 (worried) → Buy 60-90 day out puts (200% return or SKEW drops to 130)

- Under 120 (not worried) → Buy 60-90 day out calls (200% return or SKEW above 125)

★ Strategy #2. Combined Equity-Index P/C Ratio ($PCALL). Use combined P/C ratio since equity P/C is skewed towards calls (retail likes buying C). Index P/C skewed towards puts (hedges). Add a 10D SMA. Draw horizontal trendlines at 1 and 0.75. Draw dashed horizontal trendlines at 0.95 and 0.8.

- 10D SMA > 1 → Buy C 60-90 day out (everyone is short). Target 200% or drop to below 0.95.

- 10D SMA < 0.75 → Buy P 60-90 day out (everyone is long, no more buyers, market dies). Target 200% or above 0.8.

If VIX < 16, cut position size by half but double stop loss, equivalent to same position since the monetary risk is the same.

★ Two truths to trading

- You have no idea what's going to happen next

- There's no reason to be fearful of what's going to happen next, focus on the risk size, and position control

Learn to manage your account based on your account balance, an unrealized loss and a realized loss are the same damn thing.

When you're dancing with the markets, it's best to let the market lead.

Lose as if you like it; win as if you were used to it.

Respect your limitations, your limitations will not respect you.

Emotion is the enemy of successful trading. Remember, the markets are setup naturally to take advantage of and prey upon human nature, moving sharply only when enough people get trapped on the wrong side of a trade.

A trader cannot apply the same trading rules to all setups across the board.

The quickest way to fix most win ratios is to double your stop loss and cut your position size in half. You're still risking the same amount of money, but you're giving the trade enough room to work itself out.

I will not allow yesterday's success to lull me into today's complacency, for this is the great foundation of failure.

The best teacher the market has to offer: extensive personal pain and suffering.

★ Whenever I focused on the setups and not the results, I did fine. But whenever I focused on the results and not the setups, I got killed.

★ Trading habits that ruin all traders: betting it all on one trade, not using a stop because the trade "had to work out", and focusing on making a million dollars instead of waiting patiently for a high-probability trade setup. All of these habits guarantee trading failure in the long run.

/ZB bonds. Inflationary trade (industrials, energy, healthcare, banks)

Bonds go higher → interest rates go lower → long tech

Bonds go lower → interest rates go higher (inflationary) → retail, industrials, financials, materials

By focusing on "making money", a trader will see a lot of opportunity where there is none.

★★★ First, I started wiring any profits out of my trading account at the end of each week. This kept me focused on producing a smaller, steady income, as opposed to making a grand killing. I later refined this and today call it "cash flow trading," and I'll talk more about this specific trading methodology shortly. (In trading, there is trading for cash flow and trading to create wealth; they are very different.) I also discovered that wiring money out was a great way to protect profits. The market can't have them if they're safely tucked away out of reach. I use these profits mostly for longer-term investments like land and gold. But I also set aside some of the money for fun and interesting experiences—after all, we're only here once, as far as I know, and at the end of the day, it's the memories that stick with us, not the things we buy. And one important thing I realized from another successful trader is that there is no need to trade every day. I started to notice that there were days when I didn't take a trade—not because I didn't want to, but simply because the setup I was waiting for didn't occur. This turned me into a more relaxed trader as I no longer experienced FOMO: Fear of Missing Out.

Second, I started a competition among the various setups I used. This way, I could measure the performance of every one of my setups at the end of each month. The setups that made money I kept using. The setups that lost money I dumped. This was incredibly important to my trading. The only way I could keep my competition going was to execute my trade setups the same way every time. I did this in blocks of 25 trades. This had the added benefit of removing much of the importance from any trade I happened to be in at the time. It was just "trade 13 out of a series of 25"— no big deal. Any time I deviated from a standard setup, I marked this down in my trading journal as an "impulse trade." I kept track of my performance on these, too. After about six months of tracking my impulse trades (wow, this market is going higher; I must get in), I realized that they weren't making me any money and were in fact preventing me from making a living as a trader. Yes, they were fun. But they weren't helping.A In working with other traders, I see impulse trading as one of the most common reasons for people getting their heads handed to them. They don't have a plan. They just get long when that feels right, and they get short when that feels right. Or they just get bored. I've literally had traders in my office who have visited to work specifically on their impulse trades—only to sneak in orders when I wasn't looking. The urge to jump in and be a part of the action is that powerful. It's like a drug addiction, and like most addictions, it never works in the long run.

My method for dealing with them is to simply sit next to them and watch them trade—and to do exactly the opposite of what they're doing. At the end of the day or the week, we compare our profit-and-loss (P&L) statements, and that usually tells the story. This is a win/win situation because it is a great lesson for the impulse traders—there are actually people out there doing the exact opposite of what they're doing and making money—and it is a mostly profitable exercise for me. The cure for impulse trading is patience and understanding integrity—a topic that we're sneaking up to shortly. Patience is such an important quality for a trader—both in learning what setups best work for you, and in waiting for those setups to occur. Impulse traders who cannot own up to this bad habit need to stop trading and go to Las Vegas. The end result will be identical—they will lose all their money. But at least in Las Vegas the drinks are free.

If people are stuck in a relationship with an individual who berates their best efforts and undermines their dreams, then it's time to leave this individual and move on. It was in this vein that I "broke up" with my impulse trading. I liked my impulse trading. It was fun. It made me feel good, feel alive. It was exciting. But the bottom line was that my impulse trading was undermining my potential and preventing me from realizing my dreams of being a full-time trader. Once this realization took hold, I took immediate steps to cut that cancer out of my life.

In the end, I stuck with my friends who believed in me—the setups that worked when I gave them half a chance. Once I was able to follow my setups consistently, exactly the same way every time, I was able to make the transition to trading full time. A large part of my transition was mental and developing what I call a "professional state of mind"”

The best cure for whipsaw losses is to stop trading.

★★ The term itself, trader psychology, inevitably gets thrown around with greater and greater frequency as a trader nears the goal of trading the markets successfully, because the closer a trader gets to being consistent, the more apparent it becomes that his or her greatest enemy is rarely the individual on the opposite side of the trade. Far more often—as is the case in so many aspects of life—our worst enemy is the person looking back at us in the mirror each morning. Unfortunately, most traders, myself included, never realize this until they blow out an account. "Wow," they say, "I didn't think that would ever happen to me." Seasoned traders call this the price of tuition.

Stop trying to convince the market that you're right.

Trading is the only profession that punishes tenacity by taking your money. Be tenacious in learning how to become a better trader, not in proving that you're right on this current trade.

In trading, however, at the end of the day, the result is right there on your profit-and-loss (P&L) statement. No matter how "right" you persuaded yourself you were, a loss that was incurred when you were trying to prove yourself right is still a loss, and your story doesn't mean a thing to a neutral-minded market. The P&L statement is the great equalizer. It reveals you for who you really are, and in many instances the picture isn't pretty. Unfortunately, most people would rather do anything other than confront themselves or their ideal image of who they are. It's not fun. Believe me, I thought I had much better qualities as a person before I got into analyzing my trading personality. And this is why trading has such a high failure rate. Flaws explode onto the P&L statement. They must be addressed—not just in theory, not just through a few notes in a trading journal, but in practice, on every trade. The game changed for me when I committed to becoming a better trader on every trade, as opposed to rationalizing why I was right on every trade or getting caught up in my own idea of the hero's journey by hanging onto a loser for the sake of the drama and chasing the feeling of victory I craved.

★★★ The Trader Mind-Set: What Is the Best Way for Getting, and Keeping, Your Head in the Game?

Great trading, like greatness in any profession or art, is a kind of balancing act. Each trade requires us to split ourselves into two parts: caution and boldness. We need the caution to be patient, the courage to get in, the confidence to stay in a winning trade, and the caution to protect our gains once we have them—but not too aggressively, so that we don't get stopped out on a mere wiggle. Most important is the courage to admit that our trade is wrong and to get the hell out. Great trading is all of these things, which is why great traders are so rare. This balancing act is the reason so many type A personalities perform so badly in the markets. While they may possess boldness, courage, and decisiveness, they frequently lack the caution, patience, and ability to accept that their first impression was the wrong one. Or, more simply, they lack the ability to concede that, while their setup might have been as attractive as a Swedish au pair, it just didn't go the way they expected it to go. The market doesn't care if the setup was a good one. It's still going to do whatever it wants to do.

Something happens at the beginning of a trade, a psychological battle. It's that classic scene of a devil on one shoulder and an angel on the other. One tells you to hang in there with all your might, that things are going to go your way eventually, no matter what the evidence suggests. The other screams in your ear to preserve your capital, to get out, to take a tiny profit or a tiny loss. Just get out! It's a powerful sensation, especially for the beginning trader, which is why a clear trading strategy is critical. A trading plan in which you can place your faith is like a pair of mufflers, blocking out the sound of that noisy chorus. Trading without a game plan is like swimming in the Amazon River with a couple of raw steaks strapped to your waist. You might get some good exercise, but the longer you're in the water, the greater your chance of a violent end.

It's when you're not trading your plan that fear takes hold, and when fear takes hold, it's easy for you to lose perspective and exit too early, cutting your opportunity for profitability off at the knees. Yet fear can also cause traders to do something that seems the total opposite of fear. It can cause traders to ratchet up their nerve and stay in the trade long after signs of danger have presented themselves. That is, fear triggers an irrational boldness. It takes courage to stay in a trade; that much is certain. But the lesson that too many traders learn too late is that it takes just as much courage, if not more, to get out of a trade that's clearly not working. The greater a trader's nerve, the greater his or her chances of ruin.

I often think of the words of a great general who said, "Retreat is a perfectly legitimate military tactic." Of all the parallels between war and trading, none may be truer than this one. There is no shame in taking a small loss. In fact, when taking a small loss prevents you from taking a big one, it should be considered a victory. If things aren't going the way you hoped, preserve your capital and live to fight another day. And always remember, reentry is only a commission away. Go flat, take a walk, and clear your head. The market isn't going anywhere.

It sounds simple enough, as if you could simply resolve at the start of every trade that you will exit neither too early nor too late, and you'll have courage in the right measure at the right times, but it's actually a tremendous shift in perspective for most traders. We're all geniuses when we're looking at the charts in hindsight. It's making decisions in real time, clearly not knowing what exactly is going to happen next, that makes or breaks a trader. Anyone can tell you what you should have done.

Great flexibility is required when you're looking at the markets. There is a certain Zen attitude that is reached by the greatest of traders. In fact, this is one of the terrific, sometimes hilarious, paradoxes of the trading world: meeting serious traders in their seriously expensive suits, who amidst their talk about the hardcore daily battle between the bears and the bulls sprinkle in Zen proverbs. "There's no meaning to a flower unless it blooms." Or, perhaps more relevant, "No ego, no pain." The people who have learned these lessons are the ones who make money in the market, because they have learned that when you're forming an opinion of the market, that's all you're doing: forming an opinion. You must leave room for chance. And when you see that your opinion was the wrong one, you must have the courage to get out and the faith to accept another difficult truth: the opportunity will always come around one more time. Again, the markets aren't going anywhere.

Once the trader accepts the constant flow of the market and that endless renewal of opportunity, then the trader will understand that there's no need to enter the market on half-convictions. Just sit back and wait until a setup has laid itself out with clarity. Not a maybe or an almost—it's simply there, period. What if it doesn't work? It doesn't matter. When the setup presents itself, your only job is to take it, not care if it works out or not. That's what stops are for.

In the meantime, the main job of traders is to fight off their boredom and stay flat. Traders who take on a position out of boredom then spend their time managing that mediocre trade while good ones pass them by. There is a huge opportunity cost in taking mediocre setups, as it causes traders to miss the great ones. Getting in too late and getting stopped out on a normal pullback just means that someone else is eating your lunch that day. When you don't follow your plan, you help other traders who are following their plan, as your stop loss becomes their well-thought-out, well-planned entry point.

The markets change daily. Literally there is never the exact same combination of orders and trader actions from one day to the next. The gravity of that fact can be hard to grasp when you read about the same kinds of setups or anticipate the same kinds of moves day after day. But the market truly is continually changing and forming new combinations. There is an infinite number of possibilities on any given day, at any given minute. Did you know that each time you shuffle a deck of cards; the odds are that no deck of cards in history has ever been in that precise order? In fact, the odds against it are staggeringly astronomical. Imagine what that suggests about the markets, in which the variables are tremendous by comparison. For that reason, it is critical that you take a fresh look every day to consider the possibilities, not merely in relation to what you saw yesterday or the day before, but in terms solely of this moment, today. Bringing to the table no preconceptions or intentions of your own, you must always ask yourself: "What is the market showing me now"”

★★ One strategy in establishing the proper outlook is to stop thinking of your money as money. Don't think of it as money. In the world of trading, remember that money is only a tool of the game; it’s a mean to keep score. Though this removal from the literal value of money could certainly be a hazard in real life, it is an excellent habit for removing an emotional element from the trading day. The moment you lose sight of money as a tool of the game and revert to thinking of it in terms of its purchasing power, you have sentenced yourself to playing less skillfully and more emotionally, which is poison to any trader.

Your most important tool - faith in yourself that you'll follow your trading plan, which is keeping your word. There's no one else to hold you to it. You need to rely on yourself, and you need to believe with absolute conviction that you're someone who can be counted on.

Integrity in trading is the most critical component of your trading plan. Building up that integrity is easy to do. Start with the next trade. Follow your plan and follow your word, and your trading skills will increase.

The tactics that individuals use to achieve their dreams and goals in everyday life do not work in trading; in fact, they are one of the main reasons for traders' failures.

Traders will be much better off assuming every trade they take will fail. This way, they'll learn to focus on protecting their downside and minimizing their risk. The upside can take care of itself, thank you very much. It's the downside that can easily get out of hand. Be positive on life, positive that you can develop your trading skills, but pessimistic on your next trade.

The number one indicator that a trading account is going to blow up is a 20 percent drawdown followed by an increase in the frequency of trading combined with an increased use of market orders instead of limit orders. Firms that hedge see this situation develop, begin to lick their chops, and fade their customer's account, taking the opposite side of every trade.

Pro Tip: When you have a bad loss, it pays to do exactly the opposite of this. Take a break, get away from the markets, and come back in trading small, with limit orders and well-planned-out trades. Don't be the trader who comes up on the broker's radar screen as a hedging candidate.

Yes, size does matter. Bigger losses are a lot worse than smaller profits. However, a trader who takes small profits because of fear is not following a plan. A trader who is not following a plan and is reacting only to internal emotions is going to get beaten. Not maybe. Not probably. Going to.

Don't project future purchases on your current trading account. Let the market give you what it is going to give you. Be detached from the outcome. Once you have the money and have wired it out of your account, then and only then can you decide what to use it for.

Hoping to make a big purchase with as of yet unearned trading profits? This is the home-run mentality, and it's a pitfall for all traders. It's important for the trader to remember that the market is not going anywhere.

The first time I lost $1,000, I threw up. The next time, I merely choked on my own bile. By the tenth time, it became something that my intestines could handle. At that point, I realized it was time to up my trade size to where I could risk $1,500 on a trade without getting "too intense" emotionally. As the years went by, I was able to increase that to larger and larger amounts as mentally and emotionally I got used to the dollar swings on my scoreboard. And it has to be treated as such—a scoreboard. The moment you start thinking in terms of purchasing power, of something that you could buy with your winnings or could have bought with the current losing trade, all is lost. Emotions at that point rule the day, and that strategy only works to the trader's detriment. One thing I've studied over the years, and we've come out with irrefutable proof—staring harder at the screen does not make the market do what you want it to do. If you find yourself staring intently at the screen, it's a heads-up that you're trading too big for your account size.

One guy I worked with was trading 100 lots at a time in a $100,000 account (obviously using the maximum day-trading margin). Each 1-point move in the S&Ps represented $5,000. The first day he made 5 points ($25,000), and the next day he lost 7 points ($35,000). These were normal fluctuations for him, and it showed. He'd get so excited and animated that I thought he was going to implode. I had him cut his size down to 10 lots. At first he was bored, but then a strange thing happened. He wasn't excited, so he traded objectively ... and he made money. We got him to trade in the same mental state he was in when he was paper trading, and he gradually built up from there, like lifting weights in the gym. It made all the difference.

How Does a Person Learn How Not to Lose Money?

This is the trickiest part for traders to get their arms around. Learning how not to lose? In trading, first you lose, then you learn how not to lose, and then, and only then, can you get on the road to generating a consistent income. "Learning how not to lose" is a simple way of summing up everything we've talked about up to this point. It's about having the patience to wait, the courage to get out, and the integrity to follow your plan—all of that leads to learning how not to lose. It's about focusing on limiting risk, not having to be right, and limiting the downside so that the upside can take care of itself. And once this starts to sink in and you get comfortable with "learning how not to lose," then and only then can you make the transition to generating a consistent income from trading. Ironically, though we all think we're different and unique human beings, people who lose consistently in the markets over time all do the same things. These traders:

- Overtrade, or trade way too frequently.

- Use too tight stops (their fear of loss is so strong that they don't even give the trade a chance to work out).

- Trade with too much leverage; they would be far better off trading smaller size.

- Have one big loss that wipes out a big chunk of their account.

Losing traders consistently do at least one - if not all - of these four things. I've looked at hundreds of brokerage accounts, and they all tell the same story. In fact, I know traders who fixed their trading simply by doing the opposite of this.

These traders:

- Under-trade, or trade one or two solid setups each day or each week.

- Use too wide stops, staying outside of the market noise.

- Trade with appropriate leverage, which is why they're able to use wider stops.

- Never have a big losing trade; it really can be that simple.

★ The only thing the market hates is uncertainty. Discipline before vision.

A stock of market can move for any reason. It doesn't need to be logical or rational. Since market moves can be irrational, one needs to focus on limiting one's risk on every trade, not obcessing why the stock price is going up or down.

When Jesse Livermore was in the process of making his fortune, one of his favorite quotes was, "If I bought a stock and it went against me, I would sell it immediately. You can't stop and try to figure out why a stock is going in the wrong direction. The fact is that it is going in the wrong direction, and that is enough evidence for an experienced speculator to close the trade." Small losses make all the difference, and traders must learn to reward themselves for doing their job in this regard.

The most important step in becoming a successful trader is just learning to accept a loss without any anger or frustration or shame. It's just part of trading. It's not a big deal. It's just part of the process. Losses and missed trades are just part of the deal. On some days, things are just not going to come together.

The key is to have two specific sets of rules:

- There needs to be a trading methodology. For this setup, do the traders go all in or scale in? Do they scale out or get all out at a specific target? Do they trail a stop or leave it? Where is the stop placement in relation to the target? These are all things that must be set in stone before the trade is placed. Once the trade is placed, there's no room for rational thought. The setup must be followed the same way every time, or the traders will never be able to gauge whether the setup is going to help them or hurt them in their trading. Without that information, they're just making impulse trades, and those are the sucker trades.

- There needs to be a money management rule. How many shares or contracts does a trader allocate toward this setup? How much equity is a trader willing to risk on this setup over the course of a day, a week, a month, or a year? After traders do this for a while, what happens is that they develop the habit of following their rules and they eventually learn to trust themselves. Once traders learn to trust themselves, they can then free their minds to focus on the market opportunities that present themselves, instead of being wrapped up tight in a ball of fear, frustration, and doubt.

★★★ This is where traders make the transition out of the first three phases and begin to really have an opportunity to do this for a living. The transition involves focusing on developing their own trading skills instead of focusing on the money. And the skills are easy—keep your emotions in check and have the discipline to follow the setups. Don't focus on making $1,000. That is what the amateurs do. Focus on developing your skills and executing the setups the same way every time. It sounds simple enough, but I've worked with enough traders to know that most of them can't do it over the long haul. They get impatient and don't want to miss out on the action, so they jump in and chase without a clear setup. Once they do this, they go back into the barrel with all the amateurs.

Most of trading involves waiting. First, it involves waiting for a setup. Once the setup occurs, then the professional trader takes it without hesitation. The skill comes in waiting for it to set up and not succumbing to an impulse trade. Then, once he or she is in a setup, a trader needs to have the discipline to wait for the exit parameters to be hit, and not cave and bail out too early. Waiting is the hardest thing for many traders to do, but it's the waiting that separates the winners from the losers. Even for a day trade, it can be hours before a setup happens or a parameter is hit. That's the whole key: just be patient and wait. The person who chases four rabbits catches none.

Also, it's important to realize that professional traders are not in every move. It's okay to have the market leave the station without you. Catching every move is impossible, but chasing every move is the mark of an amateur. This is why it's imperative for traders to have a set of rules to follow for both entries and exits, as opposed to relying on their own gut feelings to manage a position. Develop a set of rules and have the discipline to follow them; they exist for your protection.

For me, the biggest difference in my trading occurred when I learned to ignore my brain and just focus on a handful of good setups. Once I learned the setups, the next challenge was to have the discipline to follow them the same way every time. No thinking, no hemming and hawing. I did this by recording my trading activity and grading myself on how well I executed each setup, instead of on how much money I was making or losing. Whereas focusing on the profit and loss (P&L) automatically encourages the bad habits that plague many traders, a setup-based approach encourages habits that can push a trader into the realm of consistent profitability.

My two best practical tips for turning into a profitable trader? First, try cutting your position size in half and doubling your stop. This usually fixes most problems. Next, focus on executing two well-thought-out, well-planned trades per week, instead of cranking out five trades per day. Easy peasy.

In the end, professional traders focus on limiting risk and protecting capital. Amateur traders focus on how much money they can make on each trade. Professional traders always take money away from amateurs. Amateur traders start to turn into professional traders once they stop looking for the next great technical indicator and start controlling their risk on each trade.

A trade is either working or it is not working, regardless of the story you tell yourself about who you are and what you believe to be true. If it's not working, the trade is wrong: so get out.

Traders who do this for a living spend their days waiting for specific setups to take shape. Yet one of the biggest weaknesses of most traders is a need to be in every move. If the markets start running away, many traders just can't help but jump in, fearing that they may be missing something big. This is a fatal flaw that will ruin any trader who can't control this habit. If there is anything I can hammer into your brain as you are reading this book, it is this: it is okay to miss moves. Professional traders miss moves; amateur traders try to chase every move. By listening to music or keeping a movie or series on in the background, traders have something they can use to pass the time while they wait for their specific setup to take shape. This makes them less prone to jump impulsively into trades just because they are bored or because they can't stand missing out on a move. The goal is not to catch every move in the market. The goal is to take the specific setups that you have outlined as a part of your business plan. Otherwise you are just a gunslinger, and sooner or later all gunslingers get killed.

One and two standard deviation spreads have a greater chance of working out, but in many situations, you're are risking 10 to make 1 or even 20 to make 1. It works great right up until it doesn't. When you are at-the-money, you're generally risking 1.5 to make 1, with the same premium decay benefits. Spreads are attractive because a trader doesn't have to be "dead right" to make money on the trade.

Buy ITM delta 70

When buying options, even if you plan to be in the trade for a few days, always give yourself the gift of time. Most of my two and three day trades are done on options that expire in 30 days or more. Why? The premium decay is minimal.

★★ By taking the time to understand the language of the markets, it will be much easier to navigate your way through the maze and find your way home.

- First, if you don't understand the language, you'll be able to get by, but you'll be at a disadvantage. In trading, this means not fully understanding the moves that are taking place on your screen and getting whipsawed.

- Second, never venture out without a homing beacon. In trading, this means having a pre-planned exit strategy.

More data does not equate to better decisions. This has been proven in numerous studies. What happens is that as we get more data, our mind latches onto the data that confirms our bias and discards the data that refutes it. In other words, more data causes our performance to suffer as it unwittingly gives us permission to impose our worldview on the markets. If you've ever shaken your head and said, "These markets make no sense," then you've been a victim of this phenomenon. The markets always make sense. It's our worldview that isn't in sync. It's a blow to the ego, for sure. The realization that the markets are always right - and that we have no idea what's going to happen next - is the winning formula for trading consistently.

What to look for in terms of a major upside reversal on the day (short covering)

Typically, the news will only be negative, so any rally would seem "out of the blue." As a bonus, short-covering rallies, after their initial pause, will typically see another push higher into the close, and this day did not disappoint, with the $TICK making a higher high and the $VIX continuing to push lower. Hanging on to trades like this is one of the hardest parts of trading. Learn to recognize the winners. Then just ride them until the screaming stops.

★ These are the moments that define a trader's job, which I equate to, "Sitting under a tree with a fully loaded gun, waiting for your next meal to walk by." When we chase mediocre opportunities out of boredom, we squander our bullets—both our real and psychological capital. By the time our unsuspecting prey comes walking past the tree, we're out of ammunition and miss the opportunity. This means we're out-of-the-money to trade, or, more likely, we're mentally spent and unfocused, so we miss the signs and miss the move, realizing what happened only when it's over.

$TICK 5 SMA, +/- 500 is strong conviction

The internals tell us what's happening now and what's about to happen next from a factual standpoint. It doesn't care what the reasons are; it just recognizes behavior and calls it out. "Something really bad is happening here. No clue what it is, but someone is blowing up." Meanwhile, the news is there to entertain us as the Titanic slides into the Atlantic.

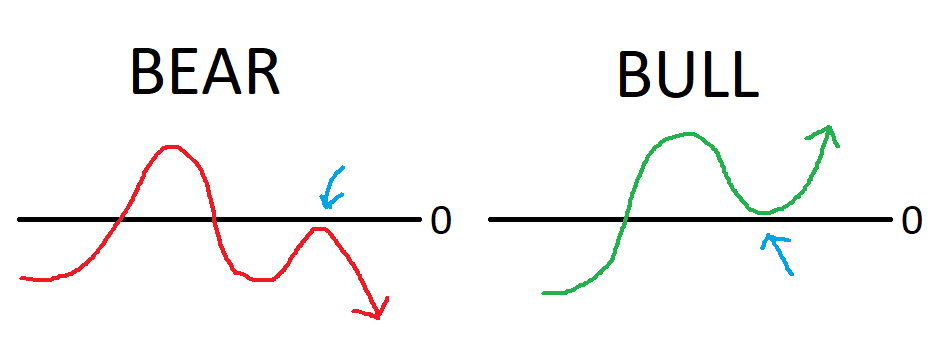

$TICK Rules

Use 5 SMA

+500 = sustained buying, -500 = sustained selling

If bullish (generally above 0), when bounce at 0 → buy signal

If bearish (generally below 0), when rejected at 0 → sell signal

Any tick reading between +/- 400 is noise so ignore (no conviction)

If readings hang out at +/- 600 → conviction

If readings exceed these levels or hang out above or below zones then conviction

If I'm long intraday and my stop hasn't been hit and the markets generate a tick reading of –1,000, bounces back to –500, then rolls over and makes a new low, I'll close out my position at the market.

Similarly, if I'm short and the markets generate a tick reading of +1,000, pulls back to +500, then pushes up to new highs, and my stop hasn't been hit, I'll close out my position at the market.

I want to make one thing perfectly clear before I move on: I never exit a trade early just because "I think I'm wrong." I've learned the hard way over many years of trading to stick to my original parameters — what I think has absolutely nothing to do with what might happen next. With the tick readings, I've designated a specific, measurable event that alerts me to get out of the trade early. A sustained tick reading of +1,000 or –1,000 is one of these specific events. My decision to get out of a trade early has nothing to do with gut feel or interpretation — human beings are woefully inadequate at making objective decisions while they're in a trade. Luckily, there's no way around a sustained tick reading of +1,000 or –1,000. Either the markets are hanging out at that level or they're not. Either we're on the right side of this, or we're not. If we're not, shut up, reverse, and try not to back over the curb. There's no emotion involved.

Most traders are atrocious at managing their exits. This isn't entirely their fault. Their minds are consumed by emotions that have been repressed for years. Repressed emotions always seek an outlet. This is indisputably the one thing that prevents most people from making a living as a trader. To put it simply, many traders manage their exits based on how they feel about the trade. Worse, if they're down on the day, they'll manage trades differently from the way they do when they're up on the day (because, of course, they want to be "right" and make money on the day), and they don't even realize this.

The ticks are a great way to see what's going on "underneath" the price action. The charts can tell you if prices are going higher or lower, but they can't tell you if the buying or selling pressure is merely fleeting or unrelenting.

When the ticks spend 90 percent of their time above zero with repeated extreme high tick readings, I ignore trading short setups all day and focus on longs. When the ticks spend 90 percent of their time below zero with repeated extreme low tick readings, I ignore trading long setups all day and focus on shorts.

Put/Call ratio > 1 → ignore short setups, focus on long

Put/Call ratio < 1 → ignore long setups, focus on short

★ If a trader relentlessly pursues a setup that works best in trending markets, he/she will get killed in choppy markets

How to check if choppy market? Look at sector watchlist, if half are green and half are red.

When daily VIX reaches top BB or closes above top BB, high chance of a market bottom and violent rally the next day.

★ When VIX is high, indicators don’t work because they are lagging.

★ As long as the setup is valid, stay in the trade. Sit on hands until you get an exit signal.

★★ Carry trade → Hedge fund movement AUD/JPY moving higher = risk on = assets rise

AUD/JPY moving lower = risk off = assets fall

During risk off, all the leftover cash goes into TNX, and USD ($DXY), bonds rally

Carry trade on → buy everything

Carry trade off → sell everything

Funds 1) Sell assets, 2) Dump high yield currency, 3) pay back

Funds borrow low-interest currency (yen or USD), put funds into a higher yielding currency (yen or USD), borrow against AUD, buy appreciating assets (stocks, gold, silver, grain, oil), anything.

Underlying inverse relationship between increasing bond yields and decreasing equities

It involves something called the "carry trade" which is a proxy for hedge fund movement. In a nutshell: institutions borrow low-interest currency (yen or USD) and put those funds into a higher yielding currency (AUD), borrow against AUD, and then buy appreciating assets (stocks, gold, silver, grain, oil). This can be anything. When the carry trade is on, buy everything. When the carry trade is off, sell everything.

During risk off, institutions are selling assets, dumping high yield currency, and then paying back the borrowed currency. AUD/JPY moving higher = risk on = assets rise. Similarly, AUD/JPY moving lower = risk off = assets fall. During risk off, all the leftover cash goes into TNX (10-year bonds) and USD. Essentially funds are rotating from risky assets into more conservative safety assets. That's why during recessions, USD rises and bonds rally.

You don't need to know everything about there is know about the markets in order to make money. You only need one high probability setup that works.

The key is to understand the game, and then work continuously to put the odds in your favor. Trading is a skill set. It's not the person who knows the most who wins.

Stay calm in the face of the complete uncertainty we face every day.

★★ Key Advice on the Path to Consistency

- Never risk more than you're willing to lose. Understand that anything can, and will, happen.

- Select your entry point carefully. With every trade you enter, recognize where your stop is BEFORE you place the trade. If your entry point is too far from your stop, pass on the trade. Do not get in at extensions.

- Understand the probability behind your setups. Learn to recognize the higher probability setups, and the ones that you trade best. Do what makes you money. Have at least three reasons for getting into each trade.

- Don't put the same amount of money into every trade. Pick the best setups and load up on those, while using lower probability setups for singles and doubles.

- Stop taking small profits. Wait until your target extension is hit, or close to it. Otherwise, you're just capping your own profits. And why would you do that?

- Stop getting shaken out. Relax and trust the setup. Most people get shaken out by watching charts on too small of a time frame and get anxious about their position. If that's you, try to determine a target and stop level when you enter the trade. Then set alerts on your platform at these levels. Then STOP watching the trade. Go do something else and let the trade play out. You will learn to trust your exit points.

- Scale both into and out of your positions. It hurts less when you're wrong. Taking profits off at predetermined levels is a good thing.

- Read psychology-based books. They will help you improve your trading, and also your life. John has several recommendations, and these helped me immensely. I especially love Trading in the Zone by Mark Douglas and Turning Pro by Steven Pressfield.

- Learn to use the right strategy at the right time. A strategy that works great in a strong directional market may fall apart when the market begins chopping around. Know how to identify the market environment.

★ Different setups work better in different market conditions/structure.

It all comes down to trading psychology and letting your winners run and cutting your losers off at the knees.

When it comes to trading for a living, all investors fall into one of three categories:

- Those who have a system that they follow each and every day

- Those who are developing a system and are on the lookout for the Holy Grail

- Those who have never believed in utilizing a specific system and just trade on instinct—and are still explaining to their spouse how they lost all their trading capital

The point of this, of course, is to emphasize the importance of facing each trading day with a game plan and of establishing a trade setup with a three-pronged approach. In addition to the actual setup, there also needs to be a foundation from which to operate the setup. This foundation consists of the following: the trading methodology, the money management technique, and the knowledge of the best markets to trade for that particular setup. In other words, it's a lot more than just "What's the entry?" Do traders scale into a trade or go all in? Do they scale out or go all out? Is it better to use a tight stop and bigger size, or a wider stop and smaller size? Does this trade work better on the mini-sized Dow or the euro currency or an individual stock like FB (Facebook)? Each market is unique. Each setup is unique. Each time frame is unique. Without these additional data, traders are destined to fail, and they are only kidding themselves if they think they can do this for a living. They may have a lot of fun for a few months or a year, and they may get an incredible high out of a great trade, but it won't last over the long haul. These are the traders that act quickly when trying to make money and that act too slowly when trying to protect what they have. The idea is to create a situation that allows a person to do this for a living - each and every day.

Keep losses small and let winners run.

★★★ As a trader, it is important that you realize that not every trade will work out. It is quite possible to get stopped out two or three times in a row before you catch a successful move. This is a normal part of trading, and it is important that a trader not get frustrated. This is why it's important to "keep losses small and let winners run." Even with an 80 percent win ratio, it doesn't mean you will only lose one out of every five at bats, as the groupings of outcomes are random. This means you could have 5 losing trades in a row over the course of 100 trades. This is why it is important to keep track of "batches" of trades. How did that block of 25 trades work out? The block of 100? If the blocks are profitable, then you are on the path to creating a consistent income.

A typical scenario I've witnessed with traders is that they get stopped out of a setup and then hesitate to take the next one, which of course turns out to be a winner. Or they get stopped out of a setup, so the next time that setup occurs, they take profits too fast. Or if the last one was a winner (or a loser), then they double up on the next one. The point of this is that a trader needs to become like a machine and just do the setups, not operate based on "how he feels about the last trade." On any given day, I will take five intraday setups. One of these will get stopped out, two will be scratched, and two will be winners. On days where my first three trades are winners, I will usually stop for the rest of the day and book my gains. If I hit a day where my first three trades are stopped out, I take the hint and go to the gym.

For me, the biggest difference in my trading occurred when I learned to ignore my brain and just focus on a handful of good setups. Once I learned the setups, the next challenge was to have the discipline to follow them the same way, each and every time. I did this by recording my trading activity for more than a year and focusing on the results for each setup. If I deviated from the setup, if I tried to outthink it and got out too early or in too late, I noted this in my data and marked it as an "impulse play." After a while, I noticed that these impulse plays didn't make me any money. I saw the light, so to speak, and suddenly my trading focus took a dramatic shift. Instead of focusing on the potential gains of a trade or worrying about missing a move, I focused on executing a flawless setup. That is the key difference between a trader who can do this for a living and a trader who lives a life of quiet frustration. I'm not going to beat around the bush on this: following setups without letting the day's or week's or month's P&L affect your thinking is very, very hard to do. But it's the difference between life and death.

It's like quitting smoking. Either people choose to light up another cigarette or they do not. They take it one day at a time. For each day they don't light up, the better the odds that they will never smoke again. It is no different in trading. For each day traders can actually be totally disciplined and follow their setups exactly as planned—even if it means standing aside when the market is racing away without them—the better the odds that they will make it in this business. If you want thrills, go to Disneyland.

It's not the actual news, but how the markets respond to the news that is important.

One of the most important steps for traders is to understand why they are making money in a particular trade — which also means understanding who exactly is losing money on the other side of the trade. Who is getting hurt and why?

It's okay to feel stress; professional traders simply don't act on it, maintaining the parameters they have set for themselves.

In general, wider stops produce more winning trades. The key with wider stops, of course, is to play only setups that have a greater than 80 percent chance of winning. In essence, one of the reasons many traders fail to make it in this business is that they are using stops that are too tight. This might seem like a contradiction, but if almost every trade is stopped out, it's tough to make any money.

When a market is going up, it is easy to think that it will go up forever. On this same note, when the market is heading down quickly, it is easy to assume that it's the end of the world. The emotion of greed is, of course, a disaster for anyone who succumbs to it because of the surge of adrenaline that runs through the body. By understanding the odds of a move above and beyond these outer levels, a trader will be able to stay more objective and take the money away from the people who are panicking.

Sell right before a target is hit and buy right before a target is hit.

Indicators work amazingly well on trending days, but they are a killer on choppy days. Price rules on choppy days.

The stock markets spend the majority of their time backing and filling. That is, they drift up to a resistance level, then turn around and drift back to a level of support, not really doing much of anything. For most of this time, there isn't much for a trader to do except wait, and that usually requires extreme patience. Many traders fail in this regard. After all, they are traders, right? They should be taking a trade or managing a trade, not just sitting around doing nothing. This is and will always be one of the biggest misconceptions about trading—the idea that a trader has to be in a trade nearly every minute or every hour of the day. In reality, there are always three positions traders can be in at any given time: they can be long, short, or flat. For day trading, being flat, meaning not having any trades on, is the best course of action 60 percent of the time. Cats don't chase the first bird they see. They crouch and wait, sometimes for hours, for the right time to pounce. And that's what the active trader should do. When something interesting actually does happen, such as a buy or sell program hitting the markets, this creates a great scalping opportunity for the alert trader. The key for traders is to be patient, sit on their hands, and wait for these moments to occur. Actively trading really means actively waiting. Overtrading is the number one reason most day traders fail.

As I state in the introduction, the financial markets are naturally set up to take advantage of and prey upon human nature. When traders see a market running away without them, their natural instinct is to jump onboard and participate in the run. Although this makes sense on paper, this feeling of "missing the move" causes more trading errors than almost anything else. This blinding urge forces amateur traders to jump into markets based solely on the fear that they are missing out on a lot of profits—as opposed to entering the market as a result of a specific setup that they have mapped out and are patiently waiting to set up. This extreme panic buying and selling is measured accurately by the ticks, and extreme tick readings provide traders with the opportunity to jump into the markets and teach the amateurs a valuable lesson.

ATR bands sloping upward, indicate, surprise, an uptrend. Because of this, I'm interested in initiating only long trades. I could initiate short trades at the upper bands, but since the upper bands are continually rising, this is an inherently lower-probability strategy than going long. For example, if we initiated a short at the upper bands, the market would just keep moving higher and stop us out. The market is still trading within its ATR, just on a steep uprising slope. (Can enter short trades at +3 ATR but since upper hands are continually rising, it is a lower-probability strategy since they could keep going higher.)

The concept of reversion to the mean is not original by any stretch of the imagination. There are two things that I've seen that throw traders for a loop on this setup. The first is the temptation, for traders to short moves to the upper band in a clearly defined uptrend. Yes, it will work at times, but it's inherently dangerous. Just go with the trend, don't fight it. This also holds true for downtrending markets—there is little need to pursue a strategy of buying the lower bands when you can just short retracements back to the mean. That's rule 1. (Advanced traders with large accounts and a scale in methodology can pull this off—shorting uptrends to the upper bands and buying downtrends to the lower bands. Newer traders with smaller accounts get chewed up and spit out trying to do this. However, using options, vertical credit spreads can safely be initiated at these levels, which I'll discuss shortly.) The second rule is that this trade becomes irrelevant once a squeeze fires off.

★★★ ATR Rules

- Try to avoid shorting moves to the upper band in a clearly defined uptrend. (Don't short @ +3 ATR if DG). It might work at times but it's dangerous. Just go with the trend don't fight it. For downtrends, don't buy at lower bands when you can short retracements back to the mean.

- For a RTM trader, ATR becomes irrelevant if squeeze is active.

- If DG and +3 ATR, don't short unless negative divergence, HH → LH

- If DR and -3 ATR, don't long unless positive divergence, LL → HL, capitulation volume

Essentially, if +/- 3 ATR don't go counter-trend unless huge divergence.

★★★ Squeeze rules

Dark dots = compression

Light dot = energy about to be released

Histogram > 0 → long

Histogram < 0 → short

Once a squeeze fires off, disregard ATR completely. ATR is now worthless. ATR will not hold prices in check when a squeeze is active.

A squeeze actually expands the ATR of a market. This is why RTM when a squeeze is active doesn't work.

1-3 weeks in the trade, buy 1+ month out

Ignore ATR when squeeze is active.

Ignore RTM until squeeze loses momentum.

The squeeze setup really shines on the bigger time frames. Hourly charts, two-hour, daily, weekly, monthly ... there is never any reason to not understand what is going on with the bigger time frames, and, should a squeeze be firing off on one of these larger time frames, there is never any reason to fight it on the lower time frames. For example, if a 60-minute chart has fired off a long squeeze on the S&P 500, then only the uninformed are pulling their hair out entering short signals on the five-minute chart during that time. "Jeez," they say, "this thing just keeps going higher!" Yep. That's the idea.

If there is an active squeeze on a higher time frame, there is never any reason to fight it on the lower time frames.

★★ The secret to swing trading is realizing that "being positioned" is half the battle, and not stressing out over a trade that is not working out right away. The markets never break when they are expected to, and they will do so only when they are good and ready, usually when the greatest number of people are unprepared. Sometimes being positioned means waiting weeks for the move to finally unfold. This requires patience and the ability to step aside and not obsessively stare at the charts all day. This is a huge problem for many traders. They sit back, they watch the charts, they get emotional, and they get faked out and close the trade. Typically, once that process has completed itself—faking out as many traders as possible—the markets will make their move. If everybody is expecting a move, then everybody will already be positioned for it. If everybody is positioned for a big down move, then everybody is already short and there is no one left to sell. It's a great system. It's also how the markets always have worked and always will work. Stick to your setup and let it play out.

★★ It is important to position size correctly for swing trades. In general, if traders cannot sleep because they are worrying about their overnight positions, then they are trading too large in relation to their account size. Swing trades have larger stops, and their position size must be reduced accordingly.

As long as it makes higher highs (long) or lower lows (short) stay in the trade, get out when it makes its first lower high or higher low.

★ Sit on your hands until you are given a clear exit signal. In fact, part of my reward system isn't focused on profits—it's focused on my ability to follow a setup from entry to exit. Every trader should have a reward system like this: not for making money, but for hanging in there and following the setup—staying in the trade until you get a specific exit signal. Taking tiny profits is easy, which is what most traders do. And that is why most traders fail; they always succumb to the easy way out, the bad habits that the markets naturally encourage and reinforce. When a trade is going your way, stick your hands underneath your butt cheeks.

★ The key to successful trading is to stay in the signal until it ends. This way, when a big move does take place, a trader will be able to stay in the trade and let the profits run. Work on developing successful habits, not staring at the P&L.

★ Many new trades make the mistake of waking up in the morning and "look for which markets are on the move". They are chasing the action. Trades who chase markets, eventually get run over.

DXY (US dollar) will rally during periods of global economic unrest. DXY going up means stocks go down.

Two factors that increase DXY: 1) Unwinding of the carry trade and 2) global economic recessions.

★ The best way to filter out squeezes that might not work out is to align trades to the larger time frame. Ignore signals in the opposite direction of the predominant larger trend.

★ Drop the ego to be right. Brainlessly trade the signal.

★ Anchor charts - refer to larger timeframe before taking trades on a smaller timeframe. Take the trade in the direction of the larger "anchor". Example: bearish hourly, don't go long on 5-min. Helps keep the overall market movement in perspective. "Why mess around with ticks when you can tally up the points." Following the larger time frame anchor allows you to distinguish signals that will trend well from those that are the quicker counter-trend moves.

Best tool for staying in a trade and not jumping out too early (exit management).

TTM Trend - Wait for 2 opposite color bars in a row to exit.

A trader who follows a specific setup, with a specific set of rules/parameters, is at a huge advantage.

The market is going to do what the market is going to do. The key is to focus on the setup and ignore the rest of the noise.

There is no reason to try to catch the exact high or the exact low in a market move. That involves too much risk and has a low probability of success.

If it's not crystal clear, don't take the trade.

3:30 PM EST is a well-known key reversal point.

★ In trading, it is never a good idea to try to catch a falling knife (buy a steep sell off) or step in front of a freight train (short on a frantic rally) because "prices look too low" or "look too high".

Catching trend reversals (tops and bottoms):

Uptrend → when the bar closes below the low of the high bar. When current bar closes below low of the high bar.

Downtrend → when the bar closes above the high of the low bar. When current bar closes above high of the low bar.

★ When the setup is there, don't make the mistake of tripping over pennies when your aim is to be picking up dollars.

★★ Working with the idea of only trading with what you're willing to lose brings me to one of the most critical aspects of my trading, especially if you're still looking to generate a profitable equity curve, and that's to risk 100 percent of the cash that you allocate to a trade. If I buy a call for $12.85, that's $1,285 US Dollars I stand to lose. If I sell a $10-wide put credit spread for $3.45 then I have $655 of risk in that trade. There is no stop. I trade small enough so that my stop-loss equals the risk I'm willing to take on the trade. Before, I would trade bigger and use a tight stop, and it seemed to always get hit. Stops were never useful in my humble opinion and like any steadfast belief, it can usually be traced back to a particular experience.

I remember the day, during the previous session I had taken a bullish position on AMZN (Amazon). I was managing an account somewhere around $5,000 and had purchased 3 long calls that we're about $1,300 each. AMZN was much cheaper back then, and I was playing these short-term, in-the-money, and looking for a few points to the upside while risking the same. The next day the stock gapped down some $25.00 and my stops, mental at the time, were toast. The $4 I had been willing to risk for each of these contracts was now looking closer to $10, and this was my first "deer in the headlights" moment. After a brief period of coaching, where John assured me that "I'd figure it out," I told myself that I would never let that happen again. From that point forward I began thinking of $13.00 options as $1,300 of risk, and I've never found myself in a situation I couldn't handle, at least as far as trading is concerned!

Another reason why I've never been an advocate of setting stops on options positions, especially spreads, is because you're effectively becoming the liquidity at those prices. When you see a market go against you, you get stopped out right at the lows and then watch the move go on without you. You created the liquidity for that move by setting your stop at what was a favorable level to buy. By risking 100 percent of the debit you pay (or the difference of the credit in spreads), you'll have better odds of making money by letting your strategy play out.

This kind of a gap situation, like we're discussing with AMZN, is always one of the most painful lessons to learn—when you think you can only lose $500 and end up losing $1,500. These are sharp stepping-stones, and making sure you never have a position on that you can't handle, is the first step in being emotionally stable when trading. If you know there's absolutely no way you can lose more than $X amount of money on a trade, you can begin to think about the setup, not where your P/L (profit and loss) is on the day.

Another reason I find this method so helpful is because you can begin to truly let your swing setups play out. When traders are buying calls and thinking, "I'll pay $16.00 for this long option and use a stop at $11.00," they're not taking intraday swings into consideration. It's always frustrating to have a stock come down and trigger the monetary stop you've set on the option, only to have prices recover and the stock close at the highs on the day. This is where the concept of the daily close below the 21 EMA (the 21-period exponential moving average) must be clearly understood. You can't use a stop of any kind if you're using a plan that requires you to see the trade through the end of the day. And if you're going to base the trade off a daily close, you'll have to stomach whatever the day may bring to see where we close at 3:00 p.m. CST. Maybe at the end of the day you do end up taking the tradeoff based on a close below your level, but quite often you'll be able to hold the position through the noise and see the trade through.

★ One of the most critical aspects of trading is to risk 100% of the cash that you allocate to a trade. By risking 100% of the debit you pay, you'll have better odds of making money by letting your strategy play out.

★ The first step in becoming emotionally stable when trading is to never have a position on that you can't handle. If you know there's absolutely no way you can lose more than $X amount of money on a trade, you can begin to think about the setup, not where your P/L is on the day. You can begin to truly let your swing setups play out.

★ Another page in my career that I think many traders find themselves going through, and maybe not knowing how to handle, are moments when things aren't going your way and you find yourself discouraged. I use the word discouraged, but this could also include depressed, worried, angry, furious, and/or miserable. There's a long list of emotions that trading will inevitably drive you to feel, but it's important that you don't give into them. Don't let yourself fall into a downward spiral.

★ In addition to the documented benefits of yoga, like flexibility, I've found yoga to be helpful for my trading in two ways. First, there are several poses that you take in yoga, "asanas," that have no movement but can be extremely uncomfortable. There are moments exactly like that in trading where the position you're in is uncomfortable, but you know the right thing to do is to continue to hold the position. Of course, there's a difference between uncomfortable and acute pain. That is no different than taking heat versus triggering your stop, but if you can follow a plan and breathe through the discomfort you have a much better chance of success. Yoga teaches you to breathe through these moments, and I don't think anyone would argue that learning to handle pain is a part of a successful trading career.

★★★★ When a trader has totally acknowledged that there are factors that are 100% out of your control, then the focus is no longer on finding that one bet that's a sure thing, but instead it becomes about controlling risk. If you have a strategy that has a 65% chance of working, but only apply it three times, you may not see two winners. All three may lose. But that's not an accurate reflection of the strategy over time. You'll be in the high probability situations hundreds of times, not all of them will work, but you also can't second guess which times it will work and which times it will fail.

★ The overall prevailing trend of the market comes first. Trading is hard. It will push your buttons, test your limits, and at the end of the day really give you an honest glimpse of who you are. Find balance in the highs and lows and rest each night knowing you dared greatly.

★ Rate your setups on a five-point scale, and then put different levels of capital of risk depending on how strong your setup is.

★ Carrying out an immense amount of research is the most important activity to do in selecting directional trades. Top down: overall indexes → sectors → stocks. Overall market environment always has priority.

★ Have a 10 year old look at the chart. Is it going up, down, or sideways? You should know within three seconds what the answer is. If you don't that's probably a clue its one you should skip.

★ If you are not willing to learn, no one can help you. If you are determined to learn, no one can stop you.

★★★ The difference between traders who can do this for a living and those who can't is patience - patience to wait for the right opportunity, patience to sit in a winning trade ... otherwise it's game over.

★★★ What I've learned in doing this over time is that when you get emotional and you chase, you get yourself in a mind-set where you miss what's going on. And when a real opportunity comes along, you're just not ready because you're chasing; you're emotionally invested in something that wasn't really a setup. You just felt like you were being left out. Recognizing that is just something that comes with experience. I mean, at some point you can kind of snap your fingers and say: "Okay, I'm not going to chase stuff anymore," but after a while, what happens is you just learn the opportunity cost of doing that. First, you're usually the last one to get in. And then second, your brain is all messed up, because it's a purely emotional trade, and emotional trades over the long run just aren't consistent. That's how I've learned to deal with it.

★ Acknowledge that your feelings need to be faded.

Amateurs hope, professionals steal.

★★ Being a professional is all about maintaining a specific state of mind while trading, and traders are never going to make consistent money until they achieve that frame of reference from which they operate.

★★★★ Trading Tips for Maintaining a Professional State of Mind

- Trading is simple, but it's not easy. If you want to stay in this business, leave hope at the door, focus on specific setups, and stick to your stops.

- Trading should be boring, like factory work. If there is one guarantee in trading, it is that thrill seekers and impulse traders get their accounts destroyed.

- Amateur traders turn into professional traders once they stop looking for the "next great technical indicator" and start controlling their risk on each trade.

- Be very aware of your own emotions. Irrational behavior is every trader's downfall. If you are yelling at your computer screen, imploring your stocks to move in your direction, you have to ask yourself, "Is this rational?" Ease in. Ease out. Keep your stops. No yelling. The person who is screaming should be the one on the other side of your trade.

- Watch yourself if you get too excited—excitement increases risk because it clouds judgment.

- If you come into trading with the idea of making big money, you are doomed. When accounts are blown out, this mindset is responsible most of the time.

- Don't focus on the money. Focus on executing trades well. If you are getting into and out of trades rationally, the money will take care of itself.

- If you focus on the money, you will start trying to impose your will upon the market in order to meet your financial needs. There is only one outcome for this scenario: you will hand over all your money to traders who are focused on protecting their risk and letting their winners run.

- The best way to minimize risk is not to trade. The most common problem with losing traders is that they feel that they always have to be in a trade.

- Refuse to damage your capital. This means sticking to your stops and sometimes staying out of the market.

- Stay relaxed. Place a trade and set a stop. If you get stopped out, that means that you are doing your job. You are actively protecting your capital. Professional traders actively take small losses. Amateurs resort to hope and sometimes prayer to save their trade. In life, hope is a powerful and positive thing. In trading, resorting to hope is like placing acid on your skin—the longer you leave it there, the worse the situation will get.

- Keep winners as long as they are moving your way. Let the market take you out at your target or with a trailing stop. Don't use impulse exits. Every exit is taken for a specific reason based on parameters that have been clearly defined.

- Don't overweight your trades. The more you overweight a trade, the more hope comes into play when the trade goes against you. Remember, hope in trading is like acid on skin.

- There is no logical reason to hesitate in taking a stop. Reentry is only a commission away.

- Professional traders take losses. Being wrong and not taking a loss damages your own belief in yourself and your abilities. If you can't trust yourself to stick to your stops, whom can you trust?

- Once you take a loss, you naturally forget about the trade and move on. Do yourself a favor and take advantage of any opportunity to clear your head by taking a small loss.

- If you are hesitating to get into a position when you have a clear signal, that indicates that you don't trust yourself, and that deep inside, you feel that you may let this trade get away from you. Just get into the position and set your parameters. Traders lose money in positions every day. Keep them small. The confidence you need is not in whether or not you are right; the confidence you need comes from knowing that you execute your setups the same way each and every time and do not deviate from your plan. The more you stick to your parameters, the more confidence you will have as a trader.

- Ring the register and scale out of your position. Have modest, mechanical targets for the first half of your position. Give the second half more room to run.

- Adrenaline is a sign that your ego and your emotions have reached a point where they are clouding your judgment. If you are not in a trade, do not enter a new trade when you are in this state of mind. If you are in a trade, stick to your parameters and walk away. If you are in a losing trade that has gone through your stop, exit your trade immediately and walk away from the markets.

- Embracing your opinion leads to financial ruin. When you find yourself rationalizing or justifying a decline by saying things like, "They are just shaking out weak hands here," or, "The market makers are just dropping the bid here," then you are embracing your opinion. Don't hang on to a loser. You can always get back in.

- Unfortunately, you will not learn discipline until you have wiped out a trading account. Until you have wiped out an account, you typically think that it cannot happen to you. It is precisely that attitude that makes you hold on to losers and rationalize them all the way into the ground.

- Siphon off your trading profits each month and stick them into a money market account. This action helps you to focus your attitude and reminds you that this is a business, not a place to seek thrills.

- Professional traders risk a small amount of their equity on one trade. Amateurs typically risk a large amount of equity on one trade. This type of situation creates emotions that ruin amateurs' accounts. Professional traders focus on limiting their risk and protecting their capital. Amateur traders focus on how much money they can make on each trade. Professionals always take money away from amateurs.

- The true mark of an amateur trader who is never going to make it in this business is continually blaming everything but himself for the outcome of a bad trade. The obvious difference here is accountability. For amateurs, everything having to do with the market is "outside their control." That is not reasonable thinking and really just points to individuals who have, probably for the first time, had to confront their "real self" as opposed to the perfect self or idealized self that they have constructed in their mind. This is also known as "living in a fog." People can drift through life in their own private world, where they are pretty special and can do no wrong. Unfortunately, trading rips off this mask, because you cannot dispute what has happened to your account. This is also known as "confronting reality." For many people, when they start trading, they are suddenly confronting reality for the first time in their lives. Just to see the world as it really is requires a lifetime of training, and for many people, trading the stock market is their first real step on this journey. Some people say that traders are born, not made. Not so. If you choose to see the world as it is, then you can start trading successfully tomorrow.

- Amateur traders always think, "How much money can I make on this trade?" Professional traders always think, "How much money can I lose on this trade?"

- At some point traders realize that no one can tell them exactly what is going to happen next in the market, and that they can never know how much they are going to make on a trade. Thus the only thing left to do is to determine how much risk they are willing to take in order to find out if they are right or not. The key to trading success is to focus on how much money is at risk, not on how much you can make.

★ The profitable traders learn to be aware of the psychology and emotions behind the person who is taking the opposite side of their trade. Average traders understand only their side of the trade. Superior traders understand what's happening on both sides of a trade and know how to take advantage of situations that will hurt most traders. They know how to take advantage of human weakness, and, therefore, they are able to grind most traders into the ground like so much raw meat. In essence, winning traders steal money from losing traders.

★ There are few guarantees in life, but I guarantee this: if traders allow outside circumstances to influence their level of discipline, they will get whacked with a catastrophic loss. Maybe not today and maybe not next week, but it only has to happen once.

★ To succeed as a trader, the daily distractions have to be managed. Life marches on, despite a trader's need for quiet and solitude. To be able to make a consistent living at this incredible occupation, a trader must maintain discipline no matter what is going on around him.

Nathan Lam

Nathan Lam