The real quality it takes to succeed at trading

The qualities amongst these people are not the standard qualities you might think of or read about in the many articles on what it takes to achieve great trading success. For example, you'll read standard stuff, such as how you need patience, discipline, composure, focus, etc – These are standard behaviors you need to do well in any activity, you could say the same about playing poker with your friends. Traders tell me of times where they were impatience, ill-disciplined, lacked composure, and focus. No one can escape being human. "Even Messi has bad games." These trading champions are far from exceptional when it comes to doing the unforced errors of trading. Admittedly, they may do them a little less, but they still do them with regularity. This is not where I believe they excel. They excel in other ways. Ways which may not seem obvious, and though some work long hours, I would not say any of them work longer hours than any other trader, and quite possibly less in some cases. And it is not their approach which is their edge either. There is every type of trading possible. Long-term equity, portfolio managers, momentum based macro-traders, trend-followers, relative value players, in and out day-traders and intraday traders, multi-strats, contrarians, event-driven players, semi-systematic, all types. No type of trading has a monopoly on trading success or is superior. The reason I believe that is, is because it is not the method or the system, but the person. One thing they have done well is chosen or evolved a type of trading well-suited to their personality. This is a factor not to be understated having a strong alignment between who they are, their personality, their risk philosophy their risk management style, their method/approach, their resources, and how they engage with the markets makes it easier for them to bring the best of their self to their work. But it is another type of alignment where I feel their game is won. Self-Alignment. That is a strong alignment between them and their self. That is, their true-self, not their ego-self. They have developed, nurtured, and built a strong and trusted relationship with themselves.

Why is this so important, and such a powerful edge? When you have a great relationship with yourself, you trust yourself, you believe in yourself, you resource yourself, you are self-reliant, and you can live with yourself when the pressure hots-up, and you make the inevitable unforced errors or have off-days. You are willing to back yourself, and thus you invest in yourself in key moments in the market because you trust yourself. By investing in yourself, I mean invest in doing the things that others won't: Pulling the trigger, listening to what their intuition is telling them, being that little bit more comfortable being uncomfortable, accepting they do not know and being Ok with that, changing their mind, having an open mind, not being stubborn. They can be more confident in the face of uncertainty, and less likely to doubt themselves in key moments. Not that they are strangers to doubt, they all have times when they will doubt themselves, that is human nature, but they are less likely to be negatively affected by this and can pull themselves back from these moments quicker. They are thus less likely to be owned by the market and the situations, they find themselves in, and are more likely to be owning their own journey. That provides a powerful edge which means they can pull the plug quicker on ideas that aren't working, and can commit to increasing their commitments to things that are working. These people aren't perfect, far from it. They don't know any more than anyone else, or have superior news, information, or insight. They get all the same data as everyone else. But they do not feel they have to take a trade because someone else is taking it, or that they need to adjust their position because someone else has an opposing view. They are comfortable in their process, and above all comfortable in their own skin. If they are wrong, are quite happy to own that. And when things go wrong, they do not engage in beating themselves up (if they occasionally do, they let go, and forgive themselves quickly). They accept responsibility when it is their error because they can live with themselves, they can accept that sometimes they let themselves down. And though these moments may be painful, they do not sweep them under the carpet, they reflect on them, learn from them, and rebound quickly. They are masters of one of the great ‘soft powers' self-compassion (they know no one else will do it for them). These people develop this relationship with themselves because it is the only option. If you are going to win in this difficult job, you need to be your own best ally, not your own worst enemy.

They literally have their own backs. They respect themselves and value themselves, not so highly that are arrogant. And they though they practice humility, they do not do it so much that they do not know their own self-worth. They do have egos, after all, they like coming out on top. But they work with their ego to drive them on, and they try (with emphasis on try) to not to let it corrupt their process. On all these points, these traders are not perfect, far from it, just much better than most others.

Their strong relationships with themselves did not happen by accident. It was a deliberate effort by them. And they sometimes falter, helped by the market, but when they do, they act quickly to re-connect with themselves. This development of a strong self-relationship sounds easy in principle, but its far harder in practice. Of course, a trader still needs a viable method and process (outer game), no amount of high-quality self-relationship (inner game) will overcome a flawed outer game. But once they found that, they then worked to develop themselves at the inner game level. The development of a strong inner game is far harder than the development of the outer game. You're fighting a lifetime of behaviors, tendencies and coping mechanisms, that you've evolved, which may have been suitable to get you were you are, but which may not be right for the extreme conditions and radical uncertainty of financial markets. It requires deep and hard transformational work, sacrifice, and being willing to be vulnerable, sometimes going against the grain to develop a new relationship. That is the challenge.

Every single one of those traders chose to work with a coach. That is an example of making themselves vulnerable and going against the grain. They were willing to ask for help, to expose themselves to scrutiny and to look in the mirror and heed what came back. It wasn't the coaching that made them great; they were already on that path. But the coaching helped them along the way, provided support, reassurance, smoothed out the rough edges, helped them overcome speed-bumps, challenged them, and helped propel them further, faster. You won't read anywhere on how ‘Developing your relationship with yourself' is what it takes to succeed in trading, and yet this is where the game is ultimately won. The battle is a mental battle, within you, not out there, that makes it possible to win out there.

You will repeat the same trading mistake until you stop breaking your rules.

You don't need to be a genius with macroeconomics or be a master technician to make money in trading. You need a strategy you believe in, be willing to be wrong, master executing your strategy, press when things are lined up & have a calm demeanor when it comes to managing your money.

Sometimes you win, sometimes you lose. This is trading, but more broadly, this is life. What matters isn't so much how often you win, but how much you win when you win and how much you lose when you lose.

It's not about chasing profits; it's about protecting what you have. Shift your focus from making money to managing risk. You'll see a massive change in the results you get.

If you can't decide, the answer is No.

You can win for 200 days, but still lose everything in 1 day.

Risk management is a trader's best defense.

4 hours per day:

2 hours of studying price action

1 hour of backtesting your system

1 hour of improving your edge

In 12 months, you'll be a different trader

When taking a loss, most people's first instinct is to get back the money lost at all costs.

Which often makes things worse.

Shift your perspective from money-oriented to process-oriented.

If you want to be the best, prepare to be alone. Because there can only be one.

You must assume that it's not only possible but probable that you might actually be wrong. If not, you can't set proper risk thresholds and protect yourself.

Trading is a waiting game.

Stop forcing trades. Learn to wait for your setups.

A trader who can't wait is not a successful trader.

Shrink your focus. Narrow down to 1-2 setups in specific market environments and stay right there. Ignore, mute, block anything outside that focus and become really good at one thing. You will trade less, make more and be way happier not chasing all the shiny objects.

I'm an introvert.

And one of the reasons why I became a trader is that, unlike most professions in life, you can do it completely alone.

Success or failure depends entirely on you.

You can never be the best trader in the world. You can only be the best in the world at trading your own strategy/system.

Trading is not rocket science.Don't overcomplicate things.

- Edge

- Risk management

- Emotion control / Execution

Trading is the biggest battle against your mind.

You face fear, greed, anger, sadness on a daily basis.

But if you can overcome it, you can do anything.

Capital protection before reward generation.

This is the name of the game - something that took me way too long to grasp.

Most success is built on a foundation of past failure.

Don't be afraid to disappear while you build trading skills and become a fearless successful trader.

The best traders stick to their approach.

And they fully understand and accept that they will have periods of underperformance.

Because no approach will work all the time.

They call you gambler if you lose money for 3-4 years.

They ask you how you did it if you earn more than their annual salary in 1 month.

Trading is powerful.

Stop.

Stop breaking rules. Stop fearing of missing out. Stop trying to catch every market's movement.

Focus 100% on executing your system.

Impatience is the #1 killer of your trading.

No amount of risk management or market edge will matter if your head is not in the right place.

I stopped blaming others (brokers, exchanges, talking heads, gurus, the cats) when I understood that I alone was responsible for my trading decisions and state of mind. And that's when the real progress began.

Here's the essence of risk management: Risk no more than you can afford to lose but also risk enough so that a win is meaningful. If there is no such amount, don't play.

In bear markets,

- good news is bad news

- bad news is bad news

- no news is bad news

- very bad news when the market is very oversold is good news

If your execution is bad, backtest more.

If your emotion control is bad, meditate more.

If your system is bad, practice more.

Don't waste your time doing nothing.

If you can't display an ounce of self-control when somebody cuts you off in traffic, while waiting in line at the grocery store, or even when it comes to your diet, then how do you expect to display self-control in the market?

No trader, who ever succeeded, did so because they learned to beat the market. They did so because they learned to beat themselves.

Only when you learn to do that, will you consistently be able to beat the market.

Just so you know, you're going to have to take a lot of losses on your way to success.

So, you better start getting used to them.

The more you trade, the more you realize that the hard part is being patient, disciplined, overcoming failures, and executing over 5-10 years.

Trading offers you a chance to make asymmetric bets with a decent probability of success ― unlike lotteries or other games of chance. Why people still fail to make any money at all is purely because of their lack of discipline.

One of the most suicidal things you can do in trading is to keep adding to a losing position.

A trading edge puts you in the top 20%.

Risk management puts you in the top 10%.

Emotional control puts you in the top 1%.

Finding a good setup is only a small part of the work.

Staying calm while you are executing the good setup is the real hard part.

That's why trading success is 99% execution.

How long it takes to be profitable in trading or investing depends on the quality and speed of your research to create a quantified system with an edge. After that, the discipline of execution along with the right market environment leads to profitability.

Traders must resist the need for action. It's the most difficult thing to overcome. You have to change your view at the market. It's not a place for being busy or action, it's a place for following a process which produces money as an outcome. Work on that every day.

You have to develop the ability to be content with not doing anything, sometimes for extended periods. The market won't hand you an A+ setup every day. Can you sit on your hands and pounce only when the stars are fully aligned? Most traders can't - they compulsively seek action.

Losses are part of this business.

Do not allow yourself to become bitter because of them.

Maintain that spark in your eyes.

Manage your risk, keep trading, keep learning, and keep growing.

It's not the mathematical skill that's critical to winning; it's the discipline of being able to stick to the system.

Profitable traders are specialists.

They pick one set up, one market, one strategy, and go tunnel-vision on them.

You don’t need to trade 5 times a day (or even a week) to make it as a trader. Wait for the high probability, high quality setups only. Limit/eliminate boredom trades. Results will take care of itself.

If you want to be wealthy, spend your time earning, learning, or relaxing. Outsource or ignore everything else.

If emotions rule your trading

- Reduce your size

- See how this naturally lowers pressure and stress

- Keep trading while learning to work with that reduced emotivity

- Only increase your size when you're more confident and secure in the face of losses

You'll be much happier when you realize that you are going to have losses and that they'll come unexpectedly. When losses are no longer distressful, you'll start trading at a higher level.

I was always ready to share, but before external success, nobody cared to listen.

The best traders trade by finding a niche that fits them and then becoming an expert in that niche.

Your mistakes, struggles, failures, late nights, early mornings and emotional breakdowns are part of your trading experience.

You don't get rich by spending your time to save money.

You get rich by saving your time to make money.

The real battle is not on the charts.

It's in your mind.

People who succeed in the stock market also accept periodic losses, setbacks, and unexpected occurrences. Calamitous drops do not scare them out of the game.

A trading edge makes you a good trader.

Risk management makes you a great trader.

Emotional control makes you a legendary trader.

Once you find your system, you wait patiently for your setups and execute without hesitation. Live with the results and what brought you success in the past. Rinse and repeat.

No matter how much it hurts now, someday you'll look back and realize that the struggles and pain were all a necessary part of the journey to the top.

Every successful trader felt lonely.

Every successful trader had bad moments.

Every successful trader thought of giving up.

They just didn't.

You don't need to build a billion dollar startup to be successful you know.

If you're happy, able to pay your bills, you've basically won the game.

Don't let anyone tell you otherwise.

I really don't care about the mistake I made three seconds ago in the market. What I care about is what I am going to do from the next moment on. I try to avoid any emotional attachment to a market.

Trading is mostly about patience, not continuous action.

I execute my swing trading system in about 30 minutes a day. Only a few minutes of that is entering and exiting.

The rest of the trading day is just the risk of breaking my rules.

The first step of every successful trader: Failure.

Take your losses.

Don't recoil.

Allow yourself the experience both the ups and downs of trading.

You will have to lose hundreds of trades before becoming a good trader.

If you can sleep for 7 hours without waking up in between, run a 5 km in 35 minutes, 20 push-ups in 30 seconds, climb 10 floors without panting, then things are going good for you, you are in total control of your life. Remember "If health is lost, everything is lost."

A good trade has less to do with the immediate outcome and more to do with the thought process behind it.

Trading is not a game of intelligence.

It's a game of persistence, confidence, discipline, patience.

It's a psychology game, not an IQ game.

Without discipline, you'll remain a slave to your impulses.

Every time you exert discipline, you are improving your capacity to become free.

Successful traders have the simplest trading systems.

The difference is their experience and execution level.

Strive for excellence, not perfection.

In an uncertain environment, the pursuit of perfection is downright unproductive.

A trading mistake costs you money.

A trading lesson learned brings that money back 100x

What you can't accept, comes to bite you.

What you accept, ceases to bother you.

I'm always thinking about losing money as opposed to making money. Don't focus on making money, focus on protecting what you have.

If you're on your phone or computer 24/7, watching every market move, every little change in your PnL, every influencer's hot takes, eventually you'll burn out. You're making this way harder than it needs to be just because you wish to control a process you don't even control.

If you're a greedy trader, start following your rules.

If you're an anxious trader, start reducing your risk.

If you're a scared trader, start thinking in probabilities.

If you're an angry trader, focus on the next opportunity.

Trade only if you have an edge. Stay out of the market, stop trading and wait until your edge comes back. You don't have to make money all the time. Traders are not paid by the hours they work! They are paid by making the right decisions.

Most traders lose because they change their trading system every month.

Few traders win because they focus on one trading system for life.

All your trading plans are 100% useless if you break rules all the time.

When you trade for money, you'll quit at the first failure.

When you trade because you love it, you'll do it forever.

Trading teaches you isolation. Because no one will understand your feelings during the process to become a successful trader.

When in doubt, get out and get a good night's sleep. I've done that lots of times and the next day everything was clear. While you are in the position, you can't think. When you get out, then you can think clearly again.

If a stock is a true market leader, you want to see this behavior:The strongest stocks outperform the general stock market up and down.

- 10% upmove in the general stock market: Stock is up 50%

- 5% correction in the general stock market: Stock is flat.

Making money from stocks look deceptively easy. The reality is that stock market is one of the toughest mental games in the world.

Develop the awareness to notice when your emotions are telling you to do something that you know you'll regret. And have the maturity to say "No, I won't do it."

Stop obsessing over the ups and downs of the PnL.

Release your attachment to short-term outcomes.

Trust the process.

Letting your profits run is uncomfortable.

It reveals your fears.

But, you gotta push yourself to stay with it.

It's the only way to truly know what you're capable of and, along the way, forge your self-confidence.

Every failure you go through in the market brings you closer to success. Because when you fail, you're not starting from scratch, you're starting from experience. And you're learning how to survive and thrive.

Be patient with your process.

Be patient with the market.

And perhaps above all, be patient with yourself.

This game is all patience.

If you want to win, you need discipline.

If you want to win big, you need confidence.

If you want to win the game, you need consistency.

The difference between top traders and everyone else is discipline. Top traders operate from discipline rather than feelings. They do what they must do regardless of how they feel.

Paradoxically, you trade better when you stop thinking about money.

Trading's downsides:If you can endure these nothing can stop your success.

- Loneliness

- Emotional pain

- Long time to overcome the learning curve

Trading is very long term stressful. So if you're planning on doing this for a long time, pace yourself. We carry our stress with us as it accumulates and at some point our mind, body, and spirit will push back. So it is essential to build in recovery time along the way.

Here's a paradox many traders will experience at some point. The more skillful they get, the less attractive money becomes. Success is no longer defined by profits, but by how well they, as traders, perform.

It's not whether or not the market is "cheap", it's whether or not the risk of where you're wrong is cheap.

The solution to most trading psychology problems is simply to just trade smaller. Find your position size comfort zone.

If you start every trade with a small position size, everything become much easier. Large position sizes create stress and pressure. Only have large position sizes if the trade is going into your preferred direction.

If you're afraid of losing money, reduce your risk.

If you're afraid of risk, think in probabilities.

If you're afraid of missing out, backtest your system more.

Fear is just an illusion.

Happiness is the state when nothing is missing. When nothing is missing, your mind shuts down and stops running into the past or future to regret something or to plan something.

If you are relentless in your pursuit, you will either get what you want, or you will die. The ability to never stop, with no additional traits, is hard to top. Being unreasonable in a world that asks you to bend the knee to its inferior reality.

Real happiness only comes as a side-effect of peace. Most of it is going to come from acceptance, not from changing your external environment.

The measure of how much you love something is what you sacrifice for it.

Trading is one of the most difficult, but rewarding skills to learn. Do not give up, you are so close to succeeding.

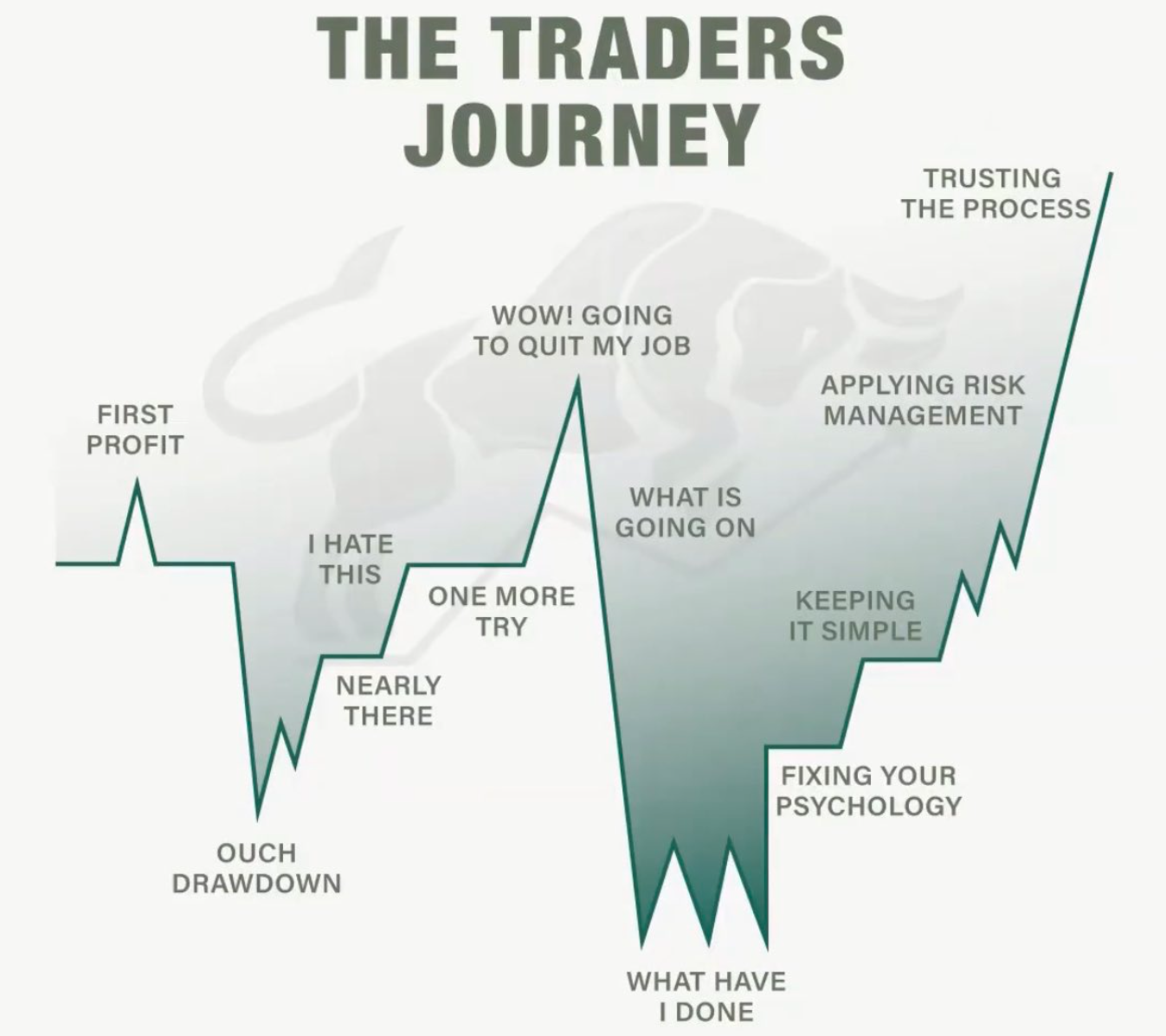

You start thinking trading is becoming a millionaire in one year.

You end up fighting against yourself every day.

Despite knowing that there's no magic system, secret formula, or special indicator that leads to trading success, I still spent many years as a trader, foolishly searching for them. Then after 13 years, I started working with a coach. This was the start of a dramatic change in my trading fortunes, that powered the next 10 years of my trading career. It was ironic, because I had probably known that the answer always lied within me, hence my fascination with psychology, self-improvement and personal growth. But knowing it and being able to access it, are two very different things. Working with a coach, whose method was rooted in psychotherapy, made a huge difference. It was not anything he said, or any special wisdom he departed, that made the difference, but rather how he worked with me, that led to a transformation. His coaching caused me to reflect deeply, to find out who "I" really was, rather than the carefully crafted fantasy version of myself, formed by my ego, that had sustained me over my entire life.

It was the defense of this fantasy version of myself, that lied at the root of my trading problems. The ego wanted this version of me to win so much, possibly too much, that I ended up continually self-sabotaging. At a deeper level, my true self could not get behind this version of me, because it was not authentic. And thus, I sought easy solutions, simple wins, external answers. It was this that stopped me from taking the true risks I needed to take to win, it was this that sought impossible perfection, it was this that bottled it at the wrong time for fear of failure. It was this that would become gloriously overconfident, just at the wrong moment, or hesitated, just when hesitation was not needed.

There is only one version of you that can ever succeed. The true authentic version of you. This has power beyond your imagination. This version of you, when accessed, can do things, that you can't believe you'd be capable of doing. When you are working in ways, that are aligned to your true self, then that is something you can get behind.

Losing, or missing out, are no longer the existential threats they seem to be, instead they are just speed-bumps along the way, a part of the journey and not catastrophes of your own making. I now coach traders, much like that coach, coached me. I meet some fantastically successful people and traders. In fact, it would be fair to say, that I am far more likely to be approached by successful traders, than unsuccessful ones. They know the value of continually working on themselves.

One of the ironies I've noticed with these people, is that when I explore with them what makes them successful, they never mention, the system they use, a secret formula they were given or found, or a special indicator exclusive to them. Their success didn't, and doesn’t, come from outside, it always came from within.

To destroy greed, start following your rules.

To destroy anxiety, start reducing your risk.

To destroy fear of losing, start thinking in probabilities.

To destroy anger, start focusing on the next opportunity.

Your trading is as good as your mindset.

Best combination ever:

- A trading edge

- Risk management

- A disciplined mind

A lesson is repeated until learned.

Everyone wants to do whatever it takes to have an edge as a trader. But I always ask them: "Can you not trade for a week or even a day?"

(silence)

Half of all traders are dopamine addicts with no willpower. They need their daily fix of "trading," and it doesn’t have to be pretty.

1 trading system

Risk management

Self-discipline + Execution

100% focus on these.

You will thank yourself in 6-12 months.

If you're not successful yet, Saturday is the best day to improve yourselfStop wasting your time.

- Plan the next trades

- Review your past trades

- Review your trading system

Why do you keep breaking your trading rules?

Trading...

They call you crazy, but you only face your emotions.

They call you a gambler, but you only take calculated risks.

They call you a workaholic, but you only work on your financial freedom.

Keep going.

The gap between where you are and where you want to be is called discipline, focus, and consistency.

The challenge isn't learning how to correctly time the market or stocks... that's the easy part. The challenge is learning how to get your emotions and idiosyncrasies out of the way of your potential.

Each day, set a time limit for trading.

If you don't see anything during that window, don't trade.

Don't squint your eyes and try to find reasons to trade.

Take the day off. Do something meaningful with your life.

And come back again the next day.

Meditation is intermittent fasting for the mind. Too much sugar leads to a heavy body, and too many distractions lead to a heavy mind. Time spent undistracted and alone, in self-examination, journaling, meditation, takes us from mentally fat to fit.

Sticking with my trading systems is all that matters to me. And the only times a trading loss upsets me is when I failed to uphold that principle.

The job of a trading signal is to create an edge with a high probability setup. It also removes your ego, emotions, and opinions from the process.

When you realize that the solution to trading's conundrum is in your mind, you will stop the holy grail chase and redirect your focus towards bettering your trading psychology.

Trading success is built on mistakes. Hundreds of them.

In trading, consistency isn't about making money.

It's about consistently executing your edge.

Money is just a by-product.

How to stay disciplined as a trader

- Have clear trading rules in front of your eyes

- Track success / failure of the trading process execution

- Focus on your long-term goal and avoid short-term focus

- Do a self-analysis every week to find improvements

In trading you have to learn to manage yourself first (emotions, learning, mindset, time). Everybody can learn the technicals, but only a few people are continuously working on managing themselves.

When a 20 year veteran trader, and one of the most successful traders out there, says;

"I'm still making the same f-cking stupid mistakes I did when I started."

You realize, it's not just you, this remains forever, a hugely challenging job.

Don't stop.

The amount of losses, mistakes and failures can really mess up your brain.

Find a successful system. And then become a trading machine.

Never look back.

Knowing how little you matter is very important for your own mental health and happiness.

For some traders, the discipline and patience to do nothing when the environment is unfavorable or opportunities are lacking is a crucial element in their success.

The best traders are "one trick ponies". They master one style or one setup and that's enough to make money. They noticed how important focus is and are not interested in changing their approach. That's what you want to achieve as a trader!

If you're going through hell, keep going.

Trading changes your life.

The more you trade, the more you realize emotion control is power.

If you can control your emotions, you can do anything.

You can't expect to change and expect your friends to stay the same.

Stop focusing on money. Focus on risk, execution, following your rules, consistency. Money will follow.

Success is a test of will to see how long you will stick with what you said you would do. How long you refuse any outcome that was not the thing you wanted to happen.

The game taught me the game! That means: Practice is the best teacher. You cannot learn trading out of a book or in a video course. Trading is 99% practice!

Psychology fact: When you increase your risk, you will smash your confidence. That's why greed and revenge trading kill traders.

For years I've known who I am as a trader. I'm not a hedge fund, tv personality, analyst. I know the risk to my account. I trade within that risk. Many traders trade like their inner stock star and wonder what went wrong. I am a self-funded, self-directed, retail trader.

The only thing keeping me from burning out lately has been winning. I haven’t thought about truly enjoying life until recently. Most of the 7-year journey in the stock market was a living hell & constant grind as I fought through countless failures with no sign of hope.

Ever since I understood that I wasn't getting anywhere in trading because of my psychology, I developed this unquenching thirst for expansion and growth.

And that was key.

Trading really does change you if you stay with it long enough.

The smarter you get, the slower you read.

Failure was a key element to my life's journey.

The more confident, secure, and wiser you become, the less you feel the need to show off your successes.

The whole game is about knowing your limitations, being aware of your strengths, knowing where your edge is, cultivating that edge, learning to monetize it. Not easy, but many do succeed, with deliberate effort, persistence, commitment to self-learning & continual improvement.

Trading is the art of taking calculated risks to compound your money like no other business in the world.

Most people overestimate how well other people are doing and underestimate how well they're doing.

I need to calm down and remember that people that want to stay in my life will make that effort to do so. People that leave my life will no longer have access to me and that’s okay. I can't please everyone, and not everyone will understand me fully and that's okay.

You're going to die one day, and none of this is going to matter. So enjoy yourself. Do something positive. Project some love. Make someone happy. Laugh a little bit. Appreciate the moment. And do your work.

Please chase your dreams so when you're older you can say "oh well I tried" rather than "what if" because regret is heavier than fear of failure.

If you aren't curious about it, you'll never be good at it.

In this field, you earn more by doing less. And very simply, you do less by systemizing your trading process.

If you don't build self-discipline, you will always be a slave of your emotions. Trading is 90% psychology.

Ultimately, if you're curious about something, you will be successful at it.

The person who risks nothing does nothing, has nothing, is nothing, and becomes nothing. He may avoid suffering and sorrow, but he simply cannot learn and feel and change and grow and love and live.

Your mental health matters more than your trading account health.

Trading, at the end of the day, is simply a mind game.

This means that you must get good at controlling yourself and your destructive patterns of behavior.

Also then will the market begin to reward you.

The mental strength you develop to become a successful trader will completely change your non-trading life.

A common mistake is breaking your rules for a quick profit or because you think you can't lose. Indiscipline kills traders’ careers.

Very headline / rumor driven market requires hyper vigilant risk management. You are a risk manager first - you are a trader only when your obligation as a risk manager is fulfilled.

Don't feel bad for missing a trade.

There's always another opportunity.

Be a sniper, not a machine gunner.

You could do everything right and still lose money.

Trading is all probability.

The sooner you accept this, the better.

Trading maturity is when you realize the real enemy is yourself.

Trading is like climbing a mountain for the first 5 years to enjoy the view for the rest of your life.

Health, Love, and your Mission, in that order. Nothing else matters.

One of the hardest things for traders to accept is reducing their trade size to focus on perfecting their execution skills. Sometimes, you have to step back to better leap forward.

The worst outcome, if you fail at trading, is that you'll have to save up again and/or go back to a regular job.

The best outcome if you succeed is that you'll get to design the life of your dreams.

It's an excellent asymmetric bet if you ask me.

Fair downside; massive upside.

Every successful trader felt lonely, had bad moments, thought of giving up. They just didn't.

Be obsessed with process and improvement, not results.

Real trading starts once you realize it's not predicting the future, but it's a probability game.

Successful traders have the simplest trading systems. The difference is their experience and execution level.

Year 1: You trade your emotions instead of trading your system.

Year 5: You trade your system instead of trading your emotions.

When you understand it's a psychology business, your trading will change completely.

Trading is tough.

Often you don't have time to think and your emotions take over.

But once you learn to stay calm when you execute, you'll become unstoppable.

Break your limits.

Focus 100% on your edge. NEVER break your rules. Develop confidence. Aim for consistency.

There's still so much time to change your trading.

Just do it.

A trader who is addicted to repetition is a disciplined trader.

Be extremely patient in waiting for your trading edge.

Be extremely fearless in executing your trading edge.

Confidence is the best trading skill:A confident trader, with an edge, has no competition.

- Fearless execution

- Unlimited potential

- No negative emotions

Trading is your work. Many traders try to win the game without self-discipline, strategy, vision, patience, consistency. It's a business, not an hobby.

A gentle reminder. Try to step away from your phone or computer during the weekend. Do something meaningful with the people you love. Don't let the market consume all your attention and life. It will do that to you if you don't set your boundaries.

You should have only a few trading rules and they should be easy to abide by. Or else, you'll just struggle to generate consistency. Dumb down your trading process. Focus on simplicity.

Treat trading like a business, and expect uncertainty, loss, and stress. When trading is approached as a job, one tends to expect a regular paycheck. But the market doesn't hand paychecks, it delivers rewards and bonuses to those that are proficient at strategic risk-taking.

Your equity curve is a mirror of your psyche.

Winning makes you feel invincible. Losing makes you doubt yourself. Failing makes you want to give up. Your mindset is your weapon to succeed, not your reason to fail.

Risk management in trading determines who survives.

Make rest, recovery, and self-care your top priority. When you do,

- You look better

- You feel better

- You think better

- You trade better

Trading is brutal.

The amount of losses, emotional pain and emotional fights can really mess up your mind.

Find a successful system. And then become a machine.

Never look back.

Don't trade when your mindset isn't optimal.

Unless you're 100% sure that you will Not F**K up.

Mental edge and market edge go hand in hand—it's okay to take the day off if you're not feeling it.

That's what trading is - it's having the wisdom to say "No, not today."

Place your trade. Maybe it'll work, maybe it won't, but you'll never know until it happens. Be fearless in the face of uncertainty... this is your ticket to success.

The most difficult part of becoming a successful trader is not making money, it's learning how to change your mindset.

Nobody cares about your story until you win, so win.

Trading is 90% waiting for your setups and 10% pulling the trigger. A trader who can't wait is not a successful trader.

99% of your trading mistakes can be solved by following your rules.

Your goal as a trader is to protect your money first. Only when you've learned to protect your money can you then start to grow that money.

Every day has 100s trading opportunities. You just need only 1-2. Less is more is real in trading.

Life truly is a single-player game. Nobody stays by your side forever.

Trading is knowing what gives you an edge and staying laser-focused on that. The rest is just waiting. Waiting is 80% of the job.

Know yourself - your temperament and stress point. And don't trade a position size that you can't handle psychologically. This is key.

The more you trade, the more you realize that trading is a war of patience.

Trading is like magic. Money, skills and experience grow exponentially. You just need to be patient.

Saying "no" in trading is very important:

- No to setups which do not meet your criteria

- No to overtrading

- No to spontaneous trades

- No to trading ideas from other traders

- No to fancy trading products or software

Simplify your trading.The ability to trade like a robot is the highest form of discipline.

- Trade your edge

- Win / Lose

- Repeat

Confidence destroys fear.

Discipline destroys breaking rules.

Consistency destroys impatience.

Developing your skills is the best trading investment.

Trading is being alone with yourself.

If you can overcome a situation when you're alone...

You'll become a fearless and self-disciplined person.

Not just in trading, also in life.

The most important conversation you will ever have in your life is the one you have with yourself. Don't underestimate the importance of self-talk, visualization, and maintaining strong mental toughness.

You can't control having emotions in trading, they will arise. The key is to control your reactions to your impulses to manage them through awareness.

Patience boosts your execution.

Patience cuts your mistakes.

Patience helps you controlling your emotions.

Patience is the most important trading skill.

If you're not successful yet, use free time to get more work done. Make plans, study, practice, review your trades, invest in yourself. Just step up.

No one becomes a successful trader without learning how to wait for your trades.

If you can't develop patience, you will never control your trading emotions.

Swing trading = Huge patience + detailed plans

Scalping = Fast execution + great flexibility

Day trading = Mixed

Find your style, build your success.

Do not anticipate and move without market confirmation - being a little late in your trade is your insurance that you are right or wrong.

Patience and discipline create wealth. Ego and arrogance destroy wealth.

The amount of money I have lost trying to make something happen under the guise of "I'm a trader, so I trade" is astronomical. The vast bulk of my big profits have come from "obvious" trades. You don't find trades, trades find you. You just have to be available to take them.

Trading killers:Destroy them with discipline and consistency. Trade. Win/Lose. Repeat.

- Fear

- Greed

- Anger

- Impatience

Trading is a dream job for an introvert.

Most of us fail in life because we're too worried about what other people think. Stop giving a shit about that and be unapologetic for living the life YOU want to live. The less you care about what others think, the easier your life will become.

If you want to become a successful trader, but you are not:It's time to change your mindset.

- Developing a profitable system

- Taking care of your risk

- Building trading skills (confidence, patience, etc.)

After years of experience you get a very good feeling for the market (intuition). You experienced so many similar situations and patterns that you literally "feel" the market. Don't ignore that. It's a huge gift and helps a lot.

No one is coming to save you.

Your execution, your plans, your risk, your systems... everything depends on you.

That's why most traders fail.

Remember, it doesn’t matter what people think of you. Only validation you need is from yourself. Embrace failure & feed off your progress. We all start at zero and our goal is to take more steps forward than backwards. You will eventually go into a full sprint. Money will follow.

Trading is difficult. You spend 1-2-3 years looking for the perfect trading system, until you realize you have to work on your mindset. It's not easy to start again from 0.

Trading success hits different when no one believed in you.

If you stay patient and disciplined, the market will reward you. Draw up your plan, set your trap and wait for confirmation. Do not try to predict and jump in early.

Bad trading results teach patience.

If you want to trade stocks, you need a market filter or market model, so that you always trade in the right direction. 80% of all stocks follow the general market trend. If you trade against it, the probabilities are very low to make money.

Discipline is the ability of executing your system like a robot.

Confidence is the ability of executing your system without anyone validation.

Patience is the ability of waiting for your targets like a sniper.

Your trading mindset is your most powerful asset.

Loneliness and mental control affect your trading.

First they are your weakness, but then they become your strength.

Learning to be alone will make you unstoppable.

Lack of success made me hungry. Achieving success made me lazy. Losing success made me smarter. Getting my success back made me hungry to sustain it and never give it back again.

Society gives more attention and value to the illusion of happiness. And it's unfortunate because it pressures people to chase all the wrong things.

If you can't stay calm when price goes against you, you have a confidence problem.

Only to the extent that you've allowed yourself to feel your pain fully, without looking away, without gritting your teeth, can the process of healing begin. Familiarity breeds indifference. Pain must completely consume the old you before the new you can emerge from the ashes.

When I'm making good money it's because the rhythm in my execution is good, less about my strategy hitting levels on point. Self-awareness of being in a good rhythm is one of the best assets you have.

No more all-in trades. Stop taking stupid risks after a trading loss. Revenge trading kills traders’ careers.

Trading is a long run. 1 bad day is enough to destroy everything. Survive. Get better. Get successful.

The most dangerous mistake is breaking your trading rules.

The minute you think you've found the key to trading, I promise you the markets will change the lock.

Trading is your work. Show up, plan, execute, record mistakes, get feedback, improve, execute again. It's a business, not a hobby.

Most traders are afraid of trading. Successful trading is probability + execution + confidence + infinite repetition. If you're afraid, you will lose.

Make consistency (not profits) your number one priority.

Those who can follow their trading system without being led astray by their ego or emotions find success.

If you're not performing well in the market, it's important to know where it stems from. I always ask myself these 3 questions: Is it me? Is it the market environment? Is it my strategy? Getting to the root of your struggles requires an honest look inside yourself to fix it.

Outstanding long-term results are produced primarily by avoiding dumb decisions, rather than by making brilliant ones.

How To Bounce Back After a Big Trading Loss

A lapse in discipline, or just a sustained bleed-out of trading capital, nearly every trader will face a big loss in their career. How to bounce back after a big loss isn't complex. What is difficult is repairing the mental damage done, especially the damage to confidence. The level of confidence, where you see the market for what it is, step in whenever there's an opportunity, cut your losses when it doesn't turn out, and sit on your hands when conditions aren't right, is the confidence that can be lost after a losing streak. You may begin to question yourself, which leads to all the typical problems, like getting out of trades too quickly, holding on to them too long, skipping trades with the fear of losing, or getting into more trades than you should in an attempt to get some winning trades.

The Day of Your Loss

Every trader has bad days. As a rule, never let a bad day cost you more than you make on an average profitable day. If you average $700 on your winning days, don't lose much more than that on a bad day. Control the downside. A big loss causes all sorts of inner conflict - revenge, fear, anger, frustration, self-hate, the list goes on. After a big loss, there's no way to trade with a clear head. 250 trading days in a year, there is no rush to get back in there; today is not the day to make it all back.

Accept Responsibility

Maybe it was just a bad few days, maybe it was your biggest single loss ever, or maybe it's a life-altering loss. In the case of facing financial ruin, there isn't much to do. Don't trade until the issue is resolved. Once it is, then you can proceed to the steps below, but not before. Don't trade with a massive debt over your head with intentions of using it to abolish that debt; that's a lot of pressure and could lead to a worse predicament. There is always an excuse for a losing trade. Some are actually good excuses, but as traders, we ultimately must accept all the risks. Until we accept that we are responsible for whatever happens with our orders, history will likely repeat, and the same thing will happen again. Accept responsibility, and figure out what could have been done differently. That will help reduce the chance of it occurring again. It is also healthier than bottling up hostility and blaming others for your misfortunes. Blaming others is admitting that you don't control your own trading, and if that is the case, why are you trading? If you control your trading, then you can fix it; if others control your trading, you can't fix anything. There is always something that can be done. It may involve changing markets, having backup data connections, or having stop-losses and targets automatically sent out when a trade is entered, or maybe you set up your platform to liquidate your trades if you hit a daily SL limit. Most likely it’s because you aren’t sticking to your rules and are sizing to big. The solution is there; you just need to find it. The best way to find it is to admit that the loss resulted from not handling something well, and then taking steps to fix it. Fixing the particular issue that caused the loss is step one. There's still the issue of confidence, though. Even with the issue fixed, your confidence may be low after taking a big hit.

Realign Your Focus

When you started, you were likely overconfident, but then the market put you in your place. You developed healthy confidence over time by building your trading system, testing and practicing it, and then ultimately utilizing it for successful real-money trading. After a big loss, get back to basics. Focus on the trading plan (with any adjustments made to it) and your implementation of it. Get back to what attracted you to trading in the first place: building or learning a strategy that made money consistently. Trading is hard, so get back to loving and embracing the challenge. A string of good times can make us lazy, and often a big loss is the wake-up call. It's the market letting us know that we have drifted off course.

Practice and Rebuild Confidence

After a big loss, confidence can be low. That means the mind may not be right for trading. Not having a clear mind can cause you to skip trades, panic out of trades (trading not to lose), or be overly aggressive to get back to your old winnings. None of these is good. Take a step back, trade in a demo account for a few days. If you have been losing, you will likely save yourself money. Because it's not real money, there is also less pressure, so it's easier to focus on trading, and not worry about the financial aspect.

Start Small

A few winning days in the demo account will raise your confidence levels and put you in a better mental space to take on the markets again with real money. After a losing streak, start small; don't jump right back to the same position size you were trading before. On the first day back, trade a small position size. A winning day with a small position size will help build confidence. If you have a losing day, losing on small position sizes is easier to handle than another losing day on full position sizes. Get back into live trading at a slow pace. If you're feeling really beaten up, spend at least two to five days in simulation, and when you switch back to live trading, start small and increase position size when you have winning days. Even if you win a few days in a row, increase your position size incrementally, so it takes time to get back to your full position size. Some try to rush back into live trading after a big loss, when they aren't ready. They end up losing more. Some traders repeat this cycle forever. After you have traded bigger position sizes, it's annoying to start back with a small position size, but it's for the best. Bouncing back from a losing streak is about getting back to basics and implementing a strategy well, not about making money. Money comes from the strategy.

After 3-4-5 years you realize the real battle's always been you vs you.

A balanced life outside of the market helps put setbacks in trading into perspective.

Trading mistakes are temporary. Lessons learned that save you money in the future you stay with you forever.

From 0 to trading success:Nothing can stop you.

- Practice/Study like no one else

- Find a trading edge

- Focus 100% on your trading edge

- Execute it for the next 5 years

Not all traders are introverts, and definitely not all introverts are traders, but there's a lot of overlap, I would say. Trading can be a lonely profession, and money aside, it appeals more to those that work well on their own.

Every successful trader had losses.

Every successful trader made mistakes.

Every successful trader had failures.

They just didn't give up.

When the trend is up, people try to short it and get caught. When the trend is down, people try to play the bounce and get caught. Why don't we simply go with the established trend?

Trading is a slow process...Trading is a process of self-discovery.

- Time will make you gain skills

- Experience will make you know yourself

- Mistakes will make you a better trader

It's impossible to become a successful trader if you never follow your trading rules.

The way to consistency is through a disciplined mind and a well-crafted trading process.

Greed destroys traders.

Stop focusing on money. Focus only on execution and risk.

That's when greed goes away.

Trading is the most individual business.

In front of your computer there is only you and yourself.

You are your own competition.

Analyze your trading & mistake. That's the number one source to learn and optimize. You will improve after some years of making mistakes, analyze them and find new rules or optimizations. Traders are not born; they develop over time.

It is literally impossible to build long-term, enduring market success based on sloppy, whimsical risk procedures. Rigid risk control is at the heart of any viable trading strategy or system.

Mistakes and failures are temporary. Skills and experience stay with you forever.

It's not that markets are unpredictable, it's just that they're uncertain. And because of that uncertainty, risk management is paramount. If you don't learn to manage risk in an almost military-like way, you're toast—sooner or later, you'll reap an account-decimating loss.

To let go of something, you must allow yourself to ponder it and to feel it fully before you can move on.

Trading is hard:That's why most traders give up.

- The battle is against yourself

- Fear, greed and anger steal your money

- No one will come to save you

There is certainty in the embrace of uncertainty.

Being consistent as a trader means:

- Stick to your rules every day, week, month and year

- Don't get distracted by other people

- Ignore trades which do not meet your criteria

- Having confidence in your approach

- Doing the same trades over and over again

Confidence in trading isn't taking a trade thinking you're smarter than everyone. It's knowing your edge and staying disciplined.

Be patient in waiting for your trading edge. Be ruthless in executing your trading edge.

Most people think trading is fighting against the market. It is actually fighting against your own emotions 90% of the time.

It's ok to work hard on something most people don't understand. If you want to be the 1%, you can't expect to be understood by the 99%.

You can't make money agreeing with the consensus view, which is already embedded in the price. Yet whenever you're betting against the consensus, there's a significant probability you're going to be wrong, so you have to be humble.

Every successful trader is a product of 5-10 years of hard work, failure and experience.

Just stop.

Stop breaking rules. Stop fearing of missing out. Stop trying to catch every market's movement.

Focus 100% on executing your system.

Impatience is the #1 killer of your trading.

Work so hard until your friends and parents start calling you lucky.

Often times what gets traders in trouble is they get bored waiting for the next series of high quality/high probability setups and start to take trades that they normally wouldn't take just to satisfy that urge to trade simply for the sake of trading.

The difference between a trader that survives vs one that eventually disappears is that one has patience, discipline, and humility. They know their strengths & weakness. They remain in control. The other gets lucky every now and then before going back to working the 9 to 5.

Always ask yourself would I enter a full position right now? If the answer is no, then you wait for things to set up again. Always another trade if you wait.

When you reap a loss or a series of losses, maybe take a break. Step away from the market instead of trying to force things to happen. Come back the next day with a fresh mind... instead of allowing frustration to build up.

A simple question you can ask yourself that often changes behavior: Is what I'm about to do a step toward or away from what's important?

The greatest lesson I have learned over the years as a trader is simply this: Trade when it is easy. Don't trade when it is hard. When I insist on trading when it is hard, it's because I am needy, insecure, demanding affirmation, not content, eager to prove, bored, scared, or angry.

Don't let temporary setbacks deter you from the bigger picture. Stick with strong risk management guidelines and don't blow up. That's the best thing you can do when the market hands you lemons.

Accepting uncertainty (the possibility of reaping a loss) is arguably the toughest aspect of this game. If you don't come to terms with it, your trading is going to be influenced by moods and emotions to a considerable degree.

Trading is a journey into a world of uncertainty, insecurity and imperfection. If you haven't got your own back on that journey, it doesn't matter how smart you are, or how good your system or strategy is, you'll always struggle to reach the potential you feel you have.

How long it takes to be profitable in trading or investing depends on the quality and speed of your research to create a quantified system with an edge. After that, the discipline of execution along with the right market environment leads to profitability.

Trading requires you to be in optimal states of equilibrium (in the zone) to be able to make appropriate choices in volatile random environments that can knock you completely out of whack (disequilibrium). Self-management is vital if you're serious about winning this game.

The reality is life is a single-player game. You're born alone. You're going to die alone. All of your interpretations are alone. All your memories are alone. You're gone in three generations and nobody cares. Before you showed up, nobody cared. It's all single-player.

The most successful traders made their money in bull markets. They stay away from bear markets, because the volatility is too high and the profit opportunity limited. If you go short, you can make 100% at maximum – if you go long, your profits are not limited.

Reading a book isn't a race - the better the book, the slower it should be absorbed.

The acceptance of uncertainty is a key quality to be developed. When you flow with uncertainty, you're not resisting it; so, there's no conflict, no fear. Teachers, mentors, coaches can show the way, but all in all it's largely a personal journey that you yourself must undergo.

Pain + Reflection = Progress

It's hard to reap loss after loss. It's as if the market is pulling the rug out from under you again and again. But you must remain patient and not allow the market to get under your skin. Market edge means nothing without mental edge.

Embracing the philosophy that there are no losses in life, only lessons, will take some of the sting out of trading losses.

Trading is being alone with yourself.

If you can overcome a situation when you're alone...

You'll become a fearless and self-disciplined person.

Not just in trading, also in life.

They call you crazy when you start trading. They call you lucky after 5 years of building skills and compounding money.

The belief (and acceptance) that the future is uncertain is one of the most fundamental components of becoming a successful trader - and it's probably the most difficult to learn.

If you're in a drawdown, know that the situation will resolve itself.

But until that happens, you've to last, you've to survive.

So, remain stern with your risk control, stay focused on your process, and think long-term.

Also, take care of yourself. Every moment. Every day.

Your position size will shape how you feel about the results of your trades.

If it's too big, you'll care too much.

If it's too small, you won't care enough.

The most powerful paradoxes of trading:

- The less I trade the more money I make by avoiding trades taken from impatience and boredom with no edge.

- All my biggest profits were made on option contracts I bought not ones I sold. Option contract asymmetry favors option buyers while winning percentage favors option sellers.

- My number one job as a trader is to manage risks and keep the capital I already have not make money.

- The best traders in history were the best risk managers not the best at entries and exits. The traders that survived to be the big winners were able to accept when they were wrong and exit a losing trade.

- The ability to admit you're wrong about a trade & get out is more important than being confident in a winning trade & staying in no matter what. The risk of ruin is greatest when you have conviction about a trade & can't accept when you find yourself on the wrong side of a trend.

- Winning traders think like a casino losing traders think like gamblers. What is the best way to make money in a casino? Own the casino. Casinos are profitable because they have a mathematical edge that plays out over the long term as long as they have table betting limits.

- Opinions, projections, and predictions are worthless, trade the price action. Good trading systems can only take signals in the present moment. The future does not exist.

- At times market fundamentals can be good filters for a trader but they are always terrible masters. Price trends where it wants regardless of fundamental valuations.

- Only date your stocks but marry your risk management. Stocks are only good if they are going up.

- The smaller and more focused my watch list the better I trade what is on my watch list because I know the backtested price action and the historical charts very well.

LCC Tax Benefits for Traders

- Working as an independent trader can be a way for individuals to make extra income, or even possibly a full-time living. But like any business venture, the income generated from trading is taxable.

- If you are successful as a day trader, it can create significant tax liabilities for you. Individuals that want to participate in the stocks have several options: they can trade as individuals or sole proprietors, qualify for trader status, or trade through a business entity.

- For the active trader, creating a legal trading business will often provide the best tax treatment and asset protection.

- Unless an individual can qualify for qualified trader status (as determined by the Internal Revenue Service (IRS)), all income they generate from trading activities is considered unearned or passive income when they file their individual income taxes.

- f you cannot qualify for qualified trader status, another way to ensure you are receiving similar tax treatment (as compared to a qualified trader) is to create a separate corporate entity through which you will conduct your trading activities. Like an LLC.

- Creating a separate corporate entity to trade through is the only way to ensure that you will receive the same tax treatment as a qualified trader. You can receive all the same tax treatment as a qualified trader without having to qualify by creating a LLC.

- The IRS has an assumption that no one would go through the trouble and expense of forming the entity unless they were committed to trading as a business venture that's why the legal entity usually receives less scrutiny from the IRS.

- Now lets go over the tax benefits of starting an LLC to trade now that we know starting an LLC can provide the same benefits as a qualified trader or someone who has Trader Tax Status (TTS).

- A qualified trader is allowed to file a Schedule C form and deduct business expenses, which could include education, entertainment, margin interest, and other trading expenses. Qualified traders can also take a Section 179 deduction for equipment used in trading activities.

- Writing off up to $19,000 a year for equipment used in trading activities on Section 179 deduction is also possible. Finally, a qualified trader can elect a Section 475(f) election (also called the mark-to-market (MTM) election). Lets talk about MTM election

- Mark-to-market (MTM) accounting allows qualified traders to change their capital gains and losses to ordinary income and losses. Because gains and losses are regarded as ordinary income under MTM, all losses are deducted in the year they occur.

- Under MTM, traders are not bound by the $3,000 net capital loss limitation; they can deduct all losses in the year they occur, providing the maximum tax relief in the current year.

- Some traders will also elect MTM to avoid the 30-day wash sale rule, which disqualifies loss deductions on "substantially identical" securities bought within 30 days before or after a sale. The wash sale rule is where most traders mess up and end up owing taxes.

Don't marry a trade. Execute. Win or lose. Go on the next one. No regrets.

The measure of wealth is freedom.

The measure of health is lightness.

The measure of intellect is judgment.

The measure of wisdom is silence.

The measure of love is peace.

You don't make money, your process does, your commitment to your process does, your willingness to submit to the daily grind of your process does. Your belief in your process does. But YOU do not make money. Please don't make the mistake of thinking it is actually you.

In many ways, the stock market is like the weather in that if you don't like the current conditions, all you have to do is wait a while.

The "Rule of 16" options cheat code & how it works:

Rule: Divide an options implied volatility (IV) by 16 & you get an estimate for a 1-day stock move based on options prices

Example:

IV = 32%

32/16 = 2% = 1 day stock move

Why divide by 16?

(1/x)

IV is a 1 standard deviation (SD) estimate for stock range over 1 year

1 SD = a 68% probability that the stock price falls within the IV estimate over 1 year.

If a stock is $100 & IV = 20%

$100 * 20 = $20

There's a 68% chance the stock stays between $80 & $120

IV's are shown in 1 year (annualized) terms, even if the option expires in a month.

By using the rule of 16, you are translating that 1 year, 1 SD estimate to a 1 day estimate.

There are 365 days/year, only ~252 of those are trading days.

Traders generally exclude non-trading days from calculations, so they use ~252 trading days as a year

SQRT(252 days) = 15.87, which is rounded to 16 for simplicity

IV/SQRT(252) =

IV/16 = options implied 1 day stock move

Why use SQRT of time?

This results from models like black scholes estimating stock movement using a "random walk" process, which tells us volatility is proportional to the square root of time

Since IV is a 1 year unit, you have to therefore scale time using: SQRT(time)

They call you stupid when you start trading.

They envy you when in 1 month you earn more than their annual salary.

Trading changes relationships.

Trading is a game of statistical probability.

At the end of the day, strategy and behavioral consistency win—perhaps not individual battles but definitely the war.

So, win or lose, pat yourself on the back when you follow your trading plan.

The day you stop emphasizing each individual trade and learn to embrace uncertainty is the day your trading will change forever

The average trader has no emotion control.

When they are winning, they risk more.

When they are losing, they break rules.

It's not the system, it's the mindset.

Being rewarded for a mistake makes you unconsciously think that it's OK to do it again.

That's how the market traps you.

One of the worst things that can happen is when the market rewards you for breaking your rules.

You must identify an area on the chart where your expectation for your trade is invalidated.

You must accept that area as a point of failure and you must take your loss.

If you can't set proper risk thresholds and don't accept failure as a possibility, you can't be a trader.

Become so confident in your system that no one's opinion, trade or system can rock you.

In a volatile market, traders who use excess margin automatically begin to micro-manage their positions. Your setup(s) can be perfectly fine and eventually start to produce but by that time you already got shaken out and micro-managed your way into unforced errors (silly losses)

Ordinary men hate solitude. But the Master makes use of it, embracing his aloneness, realizing he is one with the whole universe.

Your mind is like this water, my friend. When it is agitated, it becomes difficult to see. But if you allow it to settle, the answer becomes clear.

Trusting your plan, getting into the habit of relaxing in the midst of uncertainty, learning not to panic - this is the path that leads to durable success in the market.

The older I get, the more I realize it's okay to live a life where nobody knows what you're up to.

Trading with a systematic edge is not gambling, it's a mental game based on probabilities of a proven method with a positive expectancy model and creating risk/reward ratios in your favor.

Gambling is just trying to be lucky with the odds against you.

Patience is created through Preparation. Patience is not something that can be forced, you will naturally have patience in trading if you trust your homework and know what you're looking for.

Trading a positive expectancy system means accepting controlled losses as part and parcel of the process.

A major ingredient in successful trading is self-knowledge.

If you don't take a hard look at yourself, you will keep giving your money to those that do.

5 core trading concepts you must understand:

- Hit-rate is not important to make money

- Position sizing has a big impact on trading success

- Simple & robust systems are more successful

- 80% of trading is psychology.

- Distance from markets will increase your success

If you approach the market as its student, whatever it hands you will be construed as valuable teaching moments.

If you approach the market as an arrogant know-it-all, those same lessons will be construed as attacks.

Drop your ego. Remain teachable.

Push the gas pedal when the going is good. The rest of the time, go fishing.

This is what is meant by trading price action. For each trade you must manage five things:

- Entry: Your trade entry has to be based on a quantified signal that will put the odds in your favor of the price moving in the direction to make you profitable.

- Stop loss: You must decide on the level that price should not go if the trade is going to work out in your favor. Your stop loss is the price level will you will accept that your trade is probably not going to work out and you are going to exit with a small loss.

- Position size: Based on the volatility of what you're trading & the placement of your stop loss you must decide your trade size. Consider the total percentage of your trading capital you will put into your trade & how much you will lose if your stop loss is triggered.

- Trailing stop: In winning trades you have to choose a trailing stop with price or a moving average that you will lock in profits if your winning trade reverses to that level. This is the way to maximize a winning trade by not exiting until you have a reason to.

- Profit target: This is a predetermined level where you will lock in profits if your trade gets a specific price or technical level. This a way to minimize giving back paper profits when you are satisfied with a large enough profit.

- Our success is based on how we manage our trades. How we control our emotions, maximize wins, and admit quickly when we are proven wrong about a trade.

Time and again, the market shows us that the control we believe we have is purely illusory.

Patience is the best skill you will acquire during your trading career. Nothing better than waiting for all of the noise to clear and execute your A+ setup with precision.

Rushed FOMO trades = blown accounts.

Losing in your first few years in the market is the normal process to big gains! For those struggling, this pain is necessary.

In my experience longevity in trading comes from learning how to quickly recover from your bad decisions that resulted in losses. We all make mistakes, but those that can mentally recover from them are the ones that reach the level of success they sought after.

You will repeat the same trading mistake until you learn how to master your emotions.

Real traders and investors are more passionate talking about what they have done wrong than what they have done right.

I've studied the greatest traders of all time for 20 years.

They all have 10 similarities:

- Flexibility: they are open-minded to the fact that anything can happen. They aren't stubborn with losing trades if the reasons for being in them has changed.

- Passion: They love trading, it is both their profession and game. It is like a sport to them that they enjoy winning.

- They think in probabilities. Their language of trading is math. Risk/reward ratios and odds is how they see the markets.

- They are market historians. They have studied the charts, macro, and economics of world history and understand what had happened in the past.

- Confidence: The have faith in their method and faith in their self to execute it with disciple over time.

- They ignore the noise and focus on what matters for their own strategy.

- They don't ask others for their market opinions or future predictions.

- They usually get in a trade a little late and get out of a trade a little early and make money on the majority of a move but not all of it.

- They manage their position size and risk exposure to avoid the risk of ruin. They keep the money they make.

- They focus their trading on high probability events, the path of least resistance, or the overall trend. They discount the obvious and bet on the unexpected.

Trading is not a game of making money. It is a game of not losing money. Making money takes care of itself over time. If you wait patiently and stack the deck this game gets a lot easier. You just have to find peace in doing nothing sometimes.

Finding a trading edge is only the first step, executing it with discipline over the long-term is the final step.

Fear of losing disappears once you realize you can always lose the next trade.

I took the leap and quit my job to trade full time.

Here’s how I turned trading from a side hustle to a full time job

- I saved up money. I was very stingy for a while and saved up enough money to make sure to have a rainy day fund big enough to cover at least 6 months of expenses in case things went south. This also gave me great peace of mind.

- I knew the risks. I was well aware that it wouldn’t be an easy journey and that things could very well go wrong. I took the risk because I felt I was young enough and didn’t have too many responsibilities and it was the best time to take the chance.

- I put in the work. Working for yourself sounds amazing, but it’s one of the most stressful and difficult things you can do. You need to have great discipline and routines that keep you operating a tight ship every day.

- I had a plan. I didn't just wake up one day and decide to trade full time. I had a well thought out plan just like any other business should. I had enough data from my trading to know I could perform consistently and had a plan to scale over time that I followed to a T.

- I believed in myself. At the end of the day, even with a perfect system, you'll never make it if you don't completely have faith in yourself. This mental state comes from countless hours of screen time, trading, and backtesting.

The intolerance of uncertainty is the engine that drives most trading errors.